Other

What payroll taxes need to be withheld? “Salary” taxes that the employer must calculate, withhold and

Period for filing tax claims But there is another rule that is relevant for taxpayers and

General provisions VAT is an obligation that must be calculated and paid by all economic entities,

What kind of debt can be written off Not all of the company’s debts can be written off, but only those that

September 2, 2019 Accounting Anastasia Ivanova Consulting firms use this type of analysis to understand

Home / Labor Law / Payment and Benefits / Wages Back Published: 05/04/2016

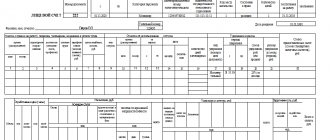

The activities of any company are based on the use of material assets and production resources. And all these

Russian companies and businessmen are given the opportunity to apply one of several types of special tax regimes, characteristic

What legal norms are regulated? A fixed-term employment contract is understood as one that is concluded for a period

Responsibilities of the deputy director as a manager The deputy is the first person in the enterprise after its director. He