Payments

When is it profitable to work with a VAT payer? If an entrepreneur pays VAT, then other companies and

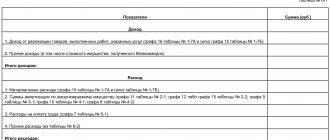

Accounting statements of individual entrepreneurs on OSNO In accordance with clause 2 of Art. 6 law from

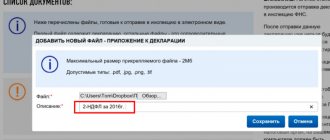

Deadlines for submitting reports to the Federal Tax Service in 2020 The table below indicates the deadlines for submission

Responsibility for non-payment of taxes is the consequences provided for by law for persons who violate the established rules

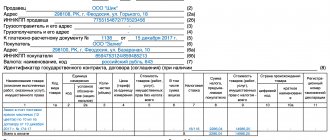

Detailed instructions for filling out invoices can be found in the Decree of the Government of the Russian Federation dated December 26, 2011

All individual entrepreneurs are required to keep a Book of Income and Expenses, abbreviated as KUDiR, with a few exceptions.

What are primary accounting documents Primary accounting documents are mandatory forms to fill out,

Calculation of the tax base As a general rule, the amount of extracted mineral resources is recognized as the tax base according to

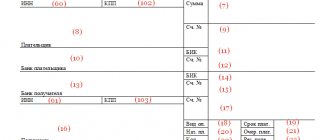

What is KBK in a payment order? The budget classification code in a payment order is a special digital code,

About the author Recent publications Alena RKO Specialist