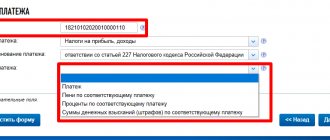

Payments

Who submits reports Non-profit organizations are required to submit reports to the Ministry of Justice. NPO reporting options:

By order dated August 21, 2017 No. 541, Rosstat approved a new report form for individual entrepreneurs.

Which organizations are required to conduct a mandatory audit of reporting: 6 cases under Law No. 307-FZ Which

Added to bookmarks: 0 How to open a framing workshop and make it a successful business? Surely

Taxes paid by individual entrepreneurs without employees and with employees for 2017 In the Russian

Who will pay the environmental tax? It applies to organizations and individuals, including individuals

Input data Today, individual entrepreneurs must pay contributions on all payments that are accrued in

What is the essence of administrative suspension of activities? Administrative suspension of activities is a punishment for violation

Home License for waste License for solid waste Obtain a license for removal of solid waste at favorable prices

What does the law say about tax audits of individual entrepreneurs? Art. 88 and 89 Tax Code