Barter and its features

Barter transactions, without the participation of funds, are carried out mainly by long-term permanent partners, the level of business trust between whom is high. This means, in essence, the netting of obligations that are repaid by simple commodity exchange. Barter related to exports (imports) is not usually converted into a monetary equivalent.

Barter can be closed or open. In the first case, partners enter into a bilateral agreement for the exchange of goods, negotiate the quantity of goods or services, and at a certain time implement their agreements. Such an agreement cannot be extended, since after completion of the exchange all obligations under it are considered fulfilled.

In the second case, several firms participate in the transaction, one of which exchanges with others in various quantities and proportions to its own goods (services). Such transactions are usually extended over time.

There is also the so-called electronic barter, when a businessman turns to the services of electronic services on the network to select the most profitable barter offers for himself. The exchange partner is selected automatically.

Barter - what is it in simple words?

Barter

– this is a form of non-cash payment in which each party to the contract acts simultaneously as a seller and a buyer. That is, barter is a commodity exchange of volumes of goods equal in price in accordance with the concluded barter agreement.

Note that in import-export barter, the exchange of goods between the parties to the transaction under the contract is carried out without the recalculation of funds.

When bartering, payment for the supplied goods is necessarily made in commodity form.

When is barter needed?

Barter for enterprises and organizations is a form of relationship where funds remain in circulation, but business processes do not suffer.

In many situations, a barter transaction is much more attractive than a monetary relationship. For example, stocking a company's warehouses forces them to get rid of surplus at a reduced price, but if they can exchange finished goods for raw materials, the company will benefit significantly.

The number of barter transactions increases during economic crisis, when enterprises need to maintain production cycles, but there is no cash flow.

In fact, enterprises and companies are switching to mutual settlement relationships, which makes it possible to carry out commodity transactions without depending on jumps in energy prices, exchange rates and other indicators. In this case, crisis costs have little effect on commodity (raw material) exchange.

Barter is convenient for partner companies that have long-standing relationships. Thus, financial losses are minimized, especially in the system of multicurrency transactions.

Disadvantages of barter transactions

The disadvantages include the difficulty of mutual assessments of goods during exchange; the goods are not valued at the most profitable value.

Barter and R“ражданский кодекс RF

Barter, barter exchange is a civil contract, according to which one party undertakes the obligation to transfer certain property to the other party in exchange for the obligation of the other party to transfer property of the same value to the first party.

Barter and transfer of ownership

By barter exchange or barter is meant such a договор мены, according to which there is a transfer of ownership of the objects of the contract between the parties to the transaction without the use of means of payment (for example, money).

Barter exchange refers to the exchange of ownership of things; services, goods between legal entities.

Types of barter

In practice, I distinguish the following types of barter:

- Closed barter

- Open barter

- Electronic barter

Closed barter

In closed barter (closed exchange), there are two parties to the transaction; the product/service of participant X is exchanged exclusively for the service/product of participant Y. The participants in the transaction communicate with each other over time and are limited to the exchange of a fixed volume of the transaction.

For example: tomorrow we will exchange 100 kg of paper for 10 windows.

Open barter

In open barter (open exchange):

- more than 2 parties can participate;

- service/good X can be exchanged for services/goods Y, Z,.. N in various proportions;

- the exchange can take place at different times.

Electronic barter

Electronic barter is the production of barter transactions using Internet services that automate the selection of barter offers that are mutually suitable for one or more parameters.

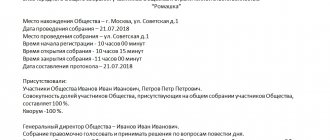

Closed barter transaction

Two parties to a transaction enter into an agreement according to which each of them receives (gives) a strictly defined product (service).

For example, a publishing house receives a certain amount of paper from a printing house in exchange for placing advertisements for the printing house on the pages of the publishing house's newspaper. This is an exchange of goods for services.

Participants in the transaction undertake to provide a certain number of tons of paper in exchange for advertising space in the newspaper for a strictly defined period of placement, for example, a year.

The principle of “product – product” is even simpler, for example, exchanging a cubic meter of timber for an equal number of nails.

Once the exchange is completed, the transaction is considered completed.

Agreements of this kind are concluded without extension.

According to the same scheme, barter of services between organizations can be carried out.

Open barter transaction

Several parties can become participants in an open barter transaction.

For example, having put up several cubic meters of wood for barter exchange, a company can exchange it in parts in several organizations for spare machine parts, nails and carrier services.

Types of barter agreements

There are different ways to negotiate settlements using a barter exchange system.

In practice, the following types of barter are distinguished:

- Counterpurchases;

- Counter deliveries;

- Barter аренда;

- Raw material-commodity barter (tolling).

Counterpurchases under a barter agreement

Counter purchases are carried out between two business entities on the terms when one party instructs the second to sell products and, with the proceeds, purchase raw materials and deliver them to the first party.

Counter deliveries under a barter agreement

Counter deliveries are a barter transaction in which the first party supplies the second with equipment.

The second, by mutual offset, supplies the first with goods produced on the equipment, or materials for the manufacture of equipment.

Barter lease under a barter agreement

Barter lease - one of the parties to the agreement rents premises and means of production to the other.

The second participant in the contractual relationship supplies produced goods (services) towards the rental price.

An option for a rental barter relationship could be repair work on premises, equipment, etc.

Raw material-commodity barter (tolling)

Barter “raw materials-products” (tolling) - one of the parties to the agreement provides raw materials for the production of products, the second processes the raw materials and returns the finished products at an offset of cost.

Taxation of barter transactions

According to the Civil and Tax Laws of the Russian Federation, a barter agreement for tax and regulatory purposes results in two sales contracts.

Under these purchase and sale agreements, each party to the transaction acts as the buyer of the property being purchased and the seller of the property being transferred.

In other words, it is believed that any barter agreement can be represented as two sales contracts by adding to the relations of the parties two obligations that are identical to each other and are directed against each other.

Natural economy

Until the Filipinos introduced money into mass circulation as a universal method of mutual settlements, trade was carried out according to the “goods-to-goods” formula.

What is barter in the classical sense? According to many definitions, barter is an agreement for the exchange of goods and services without the circulation of funds.

In this type of transaction, according to an agreement drawn up by the two parties, goods (services) of the parties to the transaction are exchanged with each other. In most cases, a barter agreement involves two parties who have decided to exchange goods.

Cash acts as collateral for the value of goods. In a standard barter transaction, the exchange of goods occurs at an estimated value, that is, the value of goods in monetary terms must be in equilibrium. But in carrying out transactions of this kind, companies can rely on their own vision of the value of the exchanged product.

Kinds

A barter agreement may contain various conditions according to which barter takes one form or another. It will differ from the direct exchange of goods and services:

- Counter purchases. It does not provide for the direct exchange of goods and services, nor does it provide for direct monetary payments. The partner accepts the goods from the company and sells them as his own. The proceeds are used to purchase other goods in which the company is interested. Such transactions are common in foreign trade.

- Counter deliveries. Exchange of goods of equal value. Economists consider counter deliveries not just barter as an element of counter trade, but barter extended over time. For example, the terms of delivery of goods for one of the parties are agreed upon by contract, but not for the other. The return delivery by barter, according to the approved conditions, will occur later, the conditions are approved by an addition to the previously concluded agreement, or by a new agreement. If the gap between the first and second circumstances is more than 1/2 year, there is a counter-delivery.

- Rent by barter. One of the parties provides production facilities, premises, and the other party provides services or goods. The services may include the complete or partial repair of the provided fixed assets.

- Tolling, or raw material-product exchange, raw material tolling agreement. One party provides raw materials, and the other processes them and then returns the finished product. The supplier pays for the processing. An agreement may be part of the scope of barter relations when there is an offset of goods (for example, the processor takes part of the product or raw materials as payment). However, payment can also be made in money.

On a note! In foreign trade practice, the maximum period between barter deliveries is considered to be six months.

Time to exchange

Some people even exchange time. Time Banking, which originated in Japan in the 1970s and in the United States in 1992, is increasingly gaining popularity. Its members spend one hour helping another member. They may receive one hour of assistance in return.

During the pandemic, many UK time banks are helping their local community. In Gloucester, Fair Shares Time Bank members are collecting recipes, shopping and delivering groceries to those hit hardest by the economic crisis. In Merseyside, Our Time is helping to bring isolated people together through video calls and quizzes.

Fiona - Taurus: 12 favorite cartoon characters and their zodiac signs

Eternal love. What does the man with whom Tamara Semina lived for half a century look like?

Shyness, low self-esteem: what Cheetah will look like in “Wonder Woman”

The nature of reciprocity means that people are more likely to accept help, viewing it as an exchange rather than charity.

Legislative basis of barter transactions

Barter, as mentioned above, is common in the foreign market, however, internal exchange of this kind also takes place. First of all, barter, according to the Civil Code of the Russian Federation, is an exchange operation (Chapter 31), and the agreement is called an exchange agreement (Article 567). According to the Civil Code, one party transfers goods to the other party in exchange for goods. There is no mention of money here, which is logical, because we are talking about commodity, barter exchange.

At the same time, the Civil Code proposes to consider barter a type of purchase and sale, with reference to the rules of Chapter. 30 of the Civil Code (each party is both a seller and a buyer). Further Art. 568 develops this idea, and clause 2 determines that a monetary equivalent may be involved in an exchange agreement if “the goods being exchanged are recognized as unequal,” and requires the difference in price to be repaid.

Foreign economic activity in relation to barter transactions is regulated by Federal Law No. 164 “On the fundamentals of state regulation of foreign economic activity” dated 12/08/2003 (Chapter 10). In particular, it prohibits barter exchange in relation to goods (services) or intellectual property that are prohibited from trade by the same Federal Law, in the “usual” way using the monetary equivalent. The main provisions of the chapter are consistent with the norms of the Civil Code discussed above.

Control over foreign trade activities in the field of barter transactions is legalized, with reference to the Federal Law, “Rules for the implementation of control over foreign trade barter transactions...” (post. Regulation No. 1207 dated 22/11/12).

What is barter: advantages and disadvantages of exchange

Barter is the exchange of goods or services with another person without the participation of money. The barter system has been in use for several millennia, long before money was invented.

In ancient times, this system could often involve people in only one locality, but today, with the use of the Internet, bartering is global.

Typically, trading is carried out through online auctions and swap markets.

History of barter

The history of barter schemes dates back to 6000 BC. Introduced by the Mesopotamian tribes, barter was adopted by the Phoenicians. The Phoenicians traded goods all over the world.

The Babylonian state also developed an improved barter system, with food, tea, weapons, and spices being exchanged. Human skulls were also used from time to time.

Salt was another popular item of exchange, so valuable that it often replaced the salaries of Roman soldiers.

During the Middle Ages, Europeans traveled around the globe to trade crafts and furs for silks and perfumes. Colonial Americans traded muskets for deerskins and wheat. When money was invented, bartering did not end, it took on a more organized form.

Due to a shortage of money, barter became popular in the 1930s during the Great Depression in the United States, and by 1933 the number of people living entirely on barter reached 60 million. That is, in fact, half the country was involved in this process. People who found themselves on the brink of starvation and survival united into mutual aid barter cooperatives or acted independently.

In-kind exchange became widespread in the economy of our country in the nineties, when workers received wages from the products of their production. The consequence was a decrease in tax revenues and a weakening of the power of the state.

Disadvantages of Barter

- The goods owner cannot immediately find those who can offer him the necessary goods and, in turn, need his goods.

- With barter there is no measure of commodity values, so it is quite difficult to establish the price of each product in relation to all others.

- Additional costs for cargo transportation. Moving most goods of significant weight and volume is associated with significant costs.

- Services and goods exchanged between you may be exchanged for substandard or defective items. You wouldn't want to trade a toy that's almost brand new and in great condition for a toy that doesn't work, would you? This can be a cautionary tale for promiscuous barkers, because good barter requires skill and experience.

Despite the listed inconveniences and difficulties, barter has always existed in the past and will exist in the future.

Benefits of barter

- As mentioned earlier, you don't need money to barter.

- Flexibility of the scheme. Even things of different types or unrelated to each other can be sold, for example, food in exchange for a laptop.

- When people travel to different countries, they can save a lot of money by exchanging houses (apartments). If your parents have friends in another country and they need somewhere to stay during a family vacation, friends can give their home to you for a period of time in exchange for your home.

- With a barter exchange, you don't have to part with things. Instead, it is enough to provide an equivalent service. For example, if your friend has a skateboard that you want to get or temporarily use, and his bike needs repairs, you can offer your bike repair services in exchange for the skateboard. With barter, both parties can get what they want or need without having to spend money.

Why is it necessary to conclude an agreement?

If the exchange involves significant amounts, it is better to use a barter agreement, where all the features of the transaction will be described and the rights and obligations of the parties will be clear.

A barter agreement allows you to explain in detail what is being traded and by whom. To receive services, you must indicate a specific task, work, or note the number of hours required for the work.

For goods, you will most likely need to include the quantity and terms of their transfer.

An exchange without agreement can backfire. On the one hand, like any contract, a paper exchange signed by the parties means that everyone must adhere to certain terms of the deal. On the other hand, depending on the situation, items and services involved in trade may be subject to tax.

If you are a business owner and by giving goods to a contractor for work performed, you are legally paying him. Both parties must take care to include this transaction in their tax calculations.

Source: https://money209.com/chto-takoe-barter-preimushhestva-i-nedostatki-obmena/

Transaction control

Control of barter transactions is entrusted to the customs service. It concerns goods, services, works, intellectual property rights (both the property itself and the rights to use them).

The Federal Customs Service is obliged to ensure that barter for foreign economic activity is confirmed by relevant documents. Accounting for such transactions is also the responsibility of the Federal Customs Service. Customs is authorized to request documents on a barter transaction, a complete list of which is contained in the “Rules” (document on state registration of a company or individual entrepreneur, document-based foreign trade activities on a barter transaction, etc.).

Documents can only be requested that the company uses in its accounting and business relationships with partners. The deadline for fulfilling the FCS request is 10 days. The FCS acts through its authorized local body, which carries out an inspection and then forwards its results to a higher authority.

Passport of a barter transaction (PBS)

PBS is a document required when carrying out foreign economic barter. The procedure for its registration (registered by the Ministry of Justice, document No. 1213 dated 12/17/96) was adopted based on the provisions of government document No. 1300 dated 10/31/96 (clause 5, paragraph 2). It is devoted to government regulatory measures in the field of barter operations in relation to foreign trade activities. The passport is issued by the Ministry of Foreign Economic Relations after the conclusion of a barter agreement by the Russian side. They receive this document for a fee.

Accounting

The Civil Code of the Russian Federation (Article 570) establishes a general rule: companies can simultaneously become owners of the barter item (for example, goods) only after both parties have received the goods, unless otherwise specified in the contract. In a situation where a company received goods through barter, but has not yet released the goods to the third party, it is not the owner of the goods received. The contract must specify the value of the goods intended for barter.

Taxes are calculated based on these indicators. VAT calculated at the book value is subject to deduction. If the goods are registered at a price lower than the contract price, VAT is additionally charged and applied to other expenses of the company.

On OSNO, revenue accounting for the purposes of BUT for barter can be done both by shipment and by payment:

- Upon shipment, the moment of receipt of income will be the day of shipment and delivery of documents for the shipment to the buyer for payment.

- The cash method determines the moment of repayment of the debt for the supply by the date of receipt of revenue for the goods. With barter, the “revenue” will be the goods received under the contract from the partner. The buyer's receivables will be paid not in cash, but in goods.

The company that shipped the goods first, but has not yet received the goods in return, cannot recognize revenue from the shipment until the transaction is fully completed in the account. 90.

It is advisable to post Dt 45 Kt 43, 41, 10, etc. and wait for the transaction to be completed. When the exchanged goods are received, a posting is made Dt 90 Kt 45. Settlement by barter Dt 60 Kt 62 should be reflected.

Incoming products or other barter items are accounted for as standard, depending on the type of value: Dt 10, 41, etc. Kt 60.

If the goods have been received by barter, but the return shipment has not yet occurred, the values are reflected behind the balance sheet on Dt 002, until the transaction is completed, and then capitalized using standard transactions. VAT on barter can be reflected on account 19 and presented for deduction.

Barter business

However, bartering isn't just used by people looking for needed items or helping with grocery shopping. In business, organizations try to increase their annual turnover by 10–15% by exchanging their services for the services of other businesses.

Entrepreneurs are increasingly interested in barter exchanges, where there are doctors, lawyers, service companies, and retailers. Members can exchange their professional services for barter credit, which can then be used to "purchase" the services of another member. In most cases, this is not a one-on-one transaction. For example, if a landscaper does $5,000 of landscaping work for a dental practice, that doesn't mean he has to exchange his labor for $5,000 worth of dental services. Rather, he has a barter exchange account, similar to a credit card, into which 5,000 trading dollars are deposited.

According to experts, during the pandemic the number of participants in barter exchanges increased by 20%.

Posting example

Let, under an exchange agreement, company A transfer finished products to company B - 3 car vacuum cleaners, in exchange for transportation services. The barter amount is indicated in the contract at 7,500 rubles, the cost of the MC is recognized as equal to the cost of services. The cost of manufacturing 3 vacuum cleaners is 3500 rubles. Both companies are on OSNO, VAT is also shown in the contract.

Company A will make the following postings:

Upon shipment:

- Dt 45 Kt 43 — 3500 rub. — shipment of vacuum cleaners.

- Dt 76/VAT Kt 68 - 1144-07 rub. — VAT is charged on the cost of goods shipped under the contract (6355-93*18%, 6355-93+1144-07= 7500-00). From 2020, the basic VAT rate is 20%.

After transportation services have been provided with the signing of documents:

- Dt 20 Kt 60 - 6355-93 - transportation costs are allocated to main production.

- Dt 19 Kt 60.

- Dt 68 Kt 19 - 1144-07 rub. — presented and accepted for deduction of VAT on transport services.

- Dt 62 Kt 90 - 7500-00 rub. — revenue from the sale of vacuum cleaners is reflected (the transaction is completed, they are now owned by company B).

- Dt 90 Kt 45 - 3500-00 rub. — the costs of manufacturing vacuum cleaners were written off.

- Dt 90 Kt 76/VAT - 1144-07 rub. — VAT on sales is recorded.

- Dt 60 Kt 62 - 7500-00 rub. — offset is reflected.

Company B will make the following postings:

Dt 002 - 7500-00 - when shipping vacuum cleaners to his address.

After providing transportation services to partners:

- Dt 62 Kt 90 - 7500-00 rub., Dt 90 Kt 68 - 1144-07 rub. — revenue is recorded, VAT is charged on the sale of services.

- Kt 002 - 7500-00 rub., Dt 10 Kt 60 - 6355-93 rub. — vacuum cleaners are put on balance.

- Dt 19 Kt 60 - 1144-07 rub., Dt 68 Kt 19 - 1144-07 rub. — VAT is presented and accepted for deduction of VAT on the supply of goods.

- Dt 60 Kt 62 - offset is reflected.

On a note! If, according to the Civil Code of the Russian Federation, the difference in cost was reflected in the contract, the one to whose address the additional payment is made would reflect it on Kt 62 upon receipt to the bank account. The one who pays extra would use Dt 60, when debiting from the current account corresponding to him - Kt 51.

Main

- A barter transaction, or the offset of obligations without the direct participation of a monetary equivalent, is called an exchange agreement in the Civil Code of the Russian Federation.

- The Civil Code allows an additional payment for a transaction if the goods are recognized as unequal in value. Barter is often used in foreign economic activity and has a number of varieties in the form of counter deliveries, purchases, etc.

- For foreign economic barter transactions, it is necessary to issue a barter transaction passport.

- Barter is recorded in accounts corresponding to the type of goods, services and other exchange items being exchanged, in correspondence with accounts for settlements with counterparties.

- Unless otherwise specified in the contract, both parties to the transaction acquire ownership of the bartered item only after the exchange is completed.