Execution of a bank guarantee

Execution of a bank guarantee is understood as the fulfillment of the guarantor’s obligations stipulated by the contract upon the occurrence of the cases described in it. The execution of the bank guarantee is entrusted to the bank, which subsequently independently returns the funds from the unscrupulous principal.

The process of executing a bank guarantee consists of several stages:

- drawing up a claim, submitting it to a financial institution and notifying the principal of the claim received by the guarantor;

- consideration of the application and verification of documents;

- making a decision and notifying all interested parties about it.

Scheme of work under a bank guarantee

In practice, concluding a commercial contract with a guarantee looks like this:

- The customer company enters into an agreement with the contractor, supplier of any goods or performer of work;

- In order to insure your financial risks in the event of failure to fulfill obligations under the contract by the contractor. Thus, the customer-beneficiary requires bank guarantees from the contractor-principal so that in the event of any negative circumstances arising due to which the contractor will not be able to fulfill the terms of the concluded agreement, he will suffer fewer losses.

- The executing company turns to a third party, usually a bank, to provide a guarantee. But another credit institution, an insurance company, or another organization can also act as a guarantor. The guarantor issues a written document to the principal that he agrees to guarantee the fulfillment of his obligations under the concluded commercial contract for the supply of goods or performance of services and agrees to undertake compensation for financial losses in the event of force majeure circumstances due to which the contractor will not be able to fulfill his obligations.

- The guarantor, for a certain fee or commission, undertakes to pay the beneficiary a certain amount of money, a percentage of the contract, or, for example, the cost of undelivered goods or the amount of damages for non-fulfillment of work, in other words, to compensate the beneficiary for the contractor.

- If the contract is broken, the beneficiary submits an application in writing for compensation for his financial losses.

- The guarantor pays the beneficiary the amount previously specified in the guarantee agreement. Then the bank will demand regressive reimbursement of the funds paid from the executor-principal.

- If the contract is completed successfully, the guarantor bank simply receives its commission for issuing the written guarantee. Note that such commissions can amount to very significant amounts and are calculated at several percent of the contract amount, etc.

Providing a bank guarantee

The bank guarantee is provided on the basis of Article 368 of the Civil Code of the Russian Federation. It is entered after submitting an application for a guarantee and the bank makes a positive decision on the application. The subject of the security is specified in the contract. This could be: a pledge, a deposit, a bill of exchange, guarantees from another financial institution, which the principal transfers to the bank. The amount of security must exceed the amount of the guarantee. The credit authority may require confirmation of the value of the collateral, for example, an expert assessment. Typically, interest rates for an unsecured guarantee are higher than for the same service with a pledge or deposit.

How to receive payment under BG

To return the amount due for an unfulfilled obligation, you must draw up a demand and attach calculations to it. You can send it via mail or on the website of the organization that was the guarantor of the transaction. If within the specified period the entire amount is not in your accounts, you need to make a demand for payment of the penalty.

Here's what you need to include in it:

- What violations were committed during the period of the agreement.

- Period of settlement with the bank: if the exact terms are not specified in the document, we recommend specifying a period of 5 working days after receipt of the request.

- Calculations of the amount owed by the principal.

- Details of the account to which funds should be received from the guarantor bank.

If you send a request by mail, then you should send it by registered mail or with a valuable document so that it can be delivered against signature by courier.

Important! If the guarantor bank does not pay the due amount on time, a penalty of 0.1% is charged daily (clause 3, part 2, article 45 of Law No. 44-FZ).

Although it is beneficial for all participants to sign a bank guarantee, the beneficiary still becomes the biggest beneficiary. He receives both the amount specified in the agreement and interest for the penalty from the bank and from the principal. Even if the supplier goes to court, the deal cannot be terminated.

The guarantor bank also receives the cost of drawing up the document itself and the interest specified in the agreement of the parties.

The principal, if he cannot fulfill his obligations towards the beneficiary, in this transaction he is the most losing party. Therefore, before taking such a step, carefully weigh everything, calculate and only then contact the bank.

Register of bank guarantees

The register of bank guarantees contains information about all issued guarantees. This requirement is fulfilled within 24 hours from the date of conclusion of the contract. Only then will the obligation come into force. The purposes of registration are the ability to verify the authenticity of documents and reduce budget losses from false guarantees.

The following information is entered into the register of banking transactions:

- name of the bank, its address TIN;

- the amount of money payable by the guarantor in the event of default by the principal;

- name, tax identification number and address of the client of the financial institution by the principal;

- a copy of the guarantee agreement;

- duration of obligations.

Problems faced by companies:

False guarantees

These guarantees are provided by banks operating under a valid license from the Central Bank. An official bank guarantee must be entered into the register; the fact of its issuance and the contents of the guarantee obligations can be easily verified.

Accounts of intermediary companies

You will pay for the guarantee not to the intermediary company, but directly to the bank that issued it.

One day guarantee

This is an impossible obligation for the intermediary company. The bank can study documents for up to 10 working days. If one bank refuses, you will have to wait for the others to respond. The intermediary’s promise to issue a bank guarantee in one day is a publicity stunt.

Overcharge

Intermediaries include their commissions in the cost of the guarantee, so the price of the guarantee is overestimated by about 5–1%. We work on bank commissions and do not inflate prices for guarantees.

Very high requirements of banks

In order to protect their interests, banks put forward high demands on applicants for guarantees. They require a large package of documents, coverage or guarantees with a pledge of property, a surety. We will select a bank for you and help you prepare the necessary documents.

Working independently is a waste of time

Everyone should do something they know and can do. We have analyzed the requirements of banks, we know what documents are needed and how to prepare them correctly, and we can competently and effectively help our clients in obtaining guarantees from licensed reliable banks. Specialization saves time and money. Save money by cooperating with us.

We'll find the best offer

Send a request

Bank guarantee conditions

The terms of a bank guarantee are determined by its type and are described by an agreement between the principal and the guarantor. Depending on the procedure for paying the beneficiary funds, a distinction is made between a guarantee on first demand (unconditional) and a conditional guarantee, which requires documentary evidence of the principal’s failure to fulfill his obligations. For example, failure to fulfill obligations can be considered improper performance of a contract, non-return of an advance payment or non-payment of customs duties, or failure to fulfill obligations by a tender participant.

Who needs a bank guarantee in Moscow

Most often, a bank guarantee in Moscow is necessary for those entrepreneurs who want to save their working capital and speed up settlements - this is especially interesting for small and medium-sized businesses.

This type of security for obligations is very beneficial, because it confirms the solvency of the company without withdrawing funds from circulation. In addition, with the help of a bank guarantee, a company can purchase goods and services with deferred payment, and also take goods for sale using the same method. In addition, practice has shown that a bank guarantee is very effective when concluding foreign economic transactions.

Registration of any bank guarantees throughout Russia in the shortest possible time (from 3 days).

We issue guarantees for:

- No. 223-FZ;

- No. 44-FZ;

- No. 185-FZ (overhaul in housing and communal services);

- payments to the state budget (tax, customs, Rosalkogolregulirovaniya);

- ensuring arbitration processes;

- commercial bilateral transactions.

From more than 88 partner banks, we will choose for you the most reliable one in your region

- All documents in electronic form

- Payment of guarantees directly to the bank

- For participation in competitions and auctions - from 2.5% of the guarantee amount.

- To secure a government contract - from 2.5% of the contract size.

- To return the advance payment under the contract - from 2.5% of the payment amount.

- To ensure quality guarantees - from 2.5% of the cost of the obligation.

Calculate the tariff and select favorable terms of receipt

Choose a bank

Limit on issuance of bank guarantees

Any company can receive a limit on the issuance of bank guarantees (BG) subject to a number of rules. Filling out an application is beneficial for organizations that often take part in tender competitions. Obtaining a limit allows you to quickly receive a bank guarantee for several years.

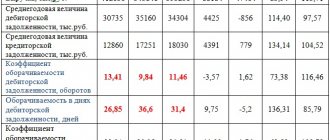

Companies with the most stable economic indicators have the greatest chance of receiving the limit. Experience in fulfilling obligations will be a plus for the organization. Banks carefully check the level of solvency of the borrower.

Contract: what is it for, features of drafting

A bank guarantee is issued on the basis of an agreement on its provision, the parties to which are the guarantor bank, the principal and the beneficiary.

Please note that a guarantee and an agreement to issue it are not the same thing.

The peculiarity of such an agreement is independent of the obligations that the guarantee must provide. This norm is enshrined in Art. 370 Civil Code of the Russian Federation. It is that the agreement:

- Does not cease or change if the main obligation has ceased or changed.

- Does not lose validity if the obligation becomes invalid.

- Provides for the guarantor's obligation to pay the obligation if the beneficiary applies again when the obligation has already been partially paid.

To conclude such an agreement, you need to collect a package of documents, which can be quite significant, especially if you are securing a government contract concluded under 44-FZ. In this case, it is advisable to arrange it through a broker. He will help you choose a bank, tell you what requirements the company must meet and help you collect documents.

Main types of bank guarantees

A guarantee is a way to ensure the fulfillment of debt obligations. By issuing a guarantee, the bank assumes the corresponding risks. There are main types of bank guarantees: payment, performance, return of advance, bill of lading, conditional, guarantees on first demand, customs.

Types of BG differ in terms of implementation. Payment guarantee is an agreement by the bank to make payments in the event of non-payment of the debt by the borrower. First Demand Guarantee – the borrower’s obligation to repay the borrowed amount after the first written application of the lender.

Why is it good?

The attractiveness of a bank guarantee is that it is immediately beneficial to all parties involved in the relationship.

For the beneficiary

The customer is absolutely sure that if a warranty case occurs, his losses will be compensated. In this case, there is no need to bother with court proceedings, selling collateral and other unpleasant problems.

He receives the money after providing the necessary papers from the guarantor, and he, according to the terms of the agreement, does not have the right to refuse to issue or reduce the amount of security.

When doing business, there are often cases when it is necessary to assure a partner of the reliability of the transaction. Moreover, many cases are prescribed by law. Participation in government contracts is one of them.

Private structures independently decide whether they need bank collateral, and most often they use it.

For the principal

Russian business is going through difficult times. Subject to strict compliance with legislative norms and contract terms, banking security becomes significant financial support. Why does the principal need a bank guarantee? Among the most common reasons for its use:

- participation in tenders and obtaining large contracts without freezing working capital;

- receiving an advance payment for work under bank collateral;

- organization of exhibitions without paying duties, materials and goods with the possibility of deferred payment;

- exemption from advance payment in case of production of excise alcohol-containing products;

- reduction of payments to tax authorities;

- protection of the company's property and working capital from judicial seizure during the process, for which purpose a guarantee is provided for the same amount.

We also recommend: Trade finance: letters of credit and bank guarantees

If no guarantee event occurs, the business does not suffer at all, paying only 3-5% of the total amount of the guarantee. But even if the bank pays the specified funds, its financial expenses will have the nature of a deferred payment for another 3 months, making it possible to use them in the form of credit funds (10-30% of the unreturned amount).

Guarantee

Why do financial institutions need a bank guarantee? Credit institutions receive income from products sold. Guarantees are one of them. But usually we are talking about large sums and solid, reliable clients, and, therefore, considerable income. Risks are compensated by deposit accounts, the presence of collateral, and guarantees from other organizations or individuals. Banks receive large profits from:

- the ability to receive payment only for the promise to pay the funds that have been in the accounts of the credit institution all this time;

- large percentages of the amount paid upon the occurrence of a warranty case;

- income from the sale of collateral in the event of the client’s failure to fulfill debt obligations.

The result of concluding an agreement on obtaining a bank guarantee will be not just the benefit of each of the participants, but also the opportunity for the development of small and medium-sized businesses as a whole, and a general improvement in the state of the economy. And these are not empty words; the popularity of this tool continues to grow every year.

Who can become a guarantor in BG?

How to get a bank guarantee?

You can find out how to obtain a bank guarantee from your bank or broker. Clients who turn to a broker for help are guaranteed to receive approval for a loan, but the cost of an agent’s services is higher than at a bank. By cooperating with the bank, the borrower receives less risk.

It is necessary to prepare a package of documents. In cooperation with a broker, the client delegates the execution of the application to the agent. Consideration of the application by the bank takes 2-3 weeks; the broker is ready to provide the bookmaker within a few days.

Procedure for issuing a guarantee

To receive a guarantee, the client must meet the bank's requirements. These requirements most often apply to the size of turnover, period of activity, financial stability and other indicators. The company must not have debts on taxes, fees, payments and loans. It is also advisable that she not participate in legal proceedings.

Before contacting the bank, you will need to prepare a package of documents. It most often includes:

- Extract from the Unified State Register of Legal Entities issued no earlier than 30 days ago

- Constituent documents - charter, protocol or decision on establishment

- Information about the founders or shareholders of the company

- The manager’s passport, agreement or decision on its establishment

- Passport of the chief accountant, document on his powers

- Accounting statements for the last reporting period

- Certificates of absence of debts, including taxes and fees

- If changes have been made to the company's record in the Unified State Register of Legal Entities - documents that confirm these changes

- License documents (if any)

- If you need collateral - documents for the pledged property or securities

- If a guarantee is needed - documents of the guarantor organization and its consent

- Contract documents or information about the competition for which a guarantee is required

The bank may require other documents to confirm the reliability of the company - for example, information about participation in other competitions or tenders.

The completed package of documents must be sent to the bank. For some time, the organization will study the potential principal and the terms of the transaction or competition. This usually takes up to three to four weeks.

What does a bank guarantee look like?

In recent years, the problem of forgery of bank documents has become more acute, so the client must thoroughly know what a bank guarantee looks like. The document is printed on company bank letterhead. The corporation issuing the guarantee must be on the list of the Ministry of Finance.

The document contains the standard text of the agreement, details of the borrower and the bank. Most banks print forms with watermarks. When contacting an intermediary for a guarantee, you should check all levels of security of the form.

How to issue a bank guarantee - 6 main steps

It can be completed either conventionally or electronically.

To receive in the usual way, print copies of documents are submitted, and it is used for large amounts from 20 million rubles. In the expedited way, the guarantee is received in just five working days.

The easiest and fastest way is to receive a document in electronic format. To do this, documents are sent online, and an electronic signature is also given. Personal presence is not necessary at any stage. But you can apply for coverage in this way for an amount not exceeding 3 million rubles.

Stage 1. The need for a guarantee arises

A bank guarantee is required for companies participating in government procurement.

This is a kind of insurance for the customer, because the bank is obliged to pay the money if the contractor suddenly fails to fulfill his obligations.

Stage 2. Search for a guarantor bank

Check out the list of banks issuing guarantees on the Ministry of Finance website.

It’s easier to get a guarantee from a bank where the company already has a current account. If your bank is not on the list of the Ministry of Finance, then ask to recommend the institution of other participants in public procurement.

There are also options for independent analysis in the government procurement register and contacting a broker.

Stage 3. Preparation of an application for the issuance of guarantees

The application is submitted to the bank. The form in which it should be drawn up is also approved by the bank. Therefore, they write it on the spot.

The application contains information about all parties to the transaction. They note all the information about the guarantee - under what conditions it is valid, what type it is, whether it can be revoked, what are the obligations of the parties.

If this is necessary, then a note is placed in the application that the guarantee is subject to the Uniform Rules or the International Practice of Reserve Obligations.

Reserve obligations are obligations for the bank to pay funds upon request or upon submission of documents confirming compliance with the conditions for payment. This includes obligations such as standby letters of credit, guarantees of non-resident banks and others.

We also recommend reading the material about letters of credit for purchasing real estate.

Stage 4. Submitting documents to the bank

An application and a project are submitted to the bank. The draft is drawn up in Russian, but if necessary, the application is duplicated in another language. A copy of the main agreement or other document on the obligations secured by the guarantee is attached to the application. The bank may also require other documents. You need to find out about this in advance.

Stage 5. Drawing up a warranty agreement

The obligations of the principal and the bank providing the guarantee are secured by agreement. The agreement specifies the procedure for the principal to pay the guarantee amount to the bank and what the procedure for providing the guarantee is. These, in fact, are the main subjects of the agreement.

The agreement provides for the debiting of a certain amount from the principal’s account or the provision of funds to the bank. The agreement reflects the conditions, terms, procedure for payments, and their amounts.

Stage 6. Payment of bank guarantees

It is important to understand that the guarantor is not responsible for the principal’s fulfillment of obligations. The bank's obligation is to pay money at the request of the beneficiary if the conditions necessary for payment are met.

This is equally true for payments from insurance companies.

Read more about how to obtain a bank guarantee in our material.

Who issues bank guarantees?

When choosing a broker to apply for a loan, you should clarify in advance who issues bank guarantees and under what conditions. An intermediary at any level turns to the bank for help, since only institutions registered with the Ministry of Finance have the right to issue guarantees. The right to issue relevant documents is also reserved for insurance companies.

Today, more than 300 banks in the Russian Federation are authorized to issue financial statements, and the list is expanding. More often, clients turn to large banks: Sberbank, VTB, Otkritie. Small financial institutions offer agreements on more favorable terms.

What organizations can issue BG

Not all banking and insurance institutions can offer BG registration. This is due to the fact that, according to Part 3 of Article 74.1 of the Tax Code, they must meet strict requirements, namely:

- Have a license from the Central Bank of the Russian Federation to carry out financial transactions.

- Do not experience the difficulties that led to the financial recovery procedure.

- Have an authorized capital of at least 300 million rubles.

- Comply with the rating from “B- (RU)” by the ACRA agency and from “ruB-” on the scale of the rating agency “Expert RA” at the time of application.

- Have no debts on payments from the turnover of budget funds.

- Deposits from individuals should not be involved in the transaction.

Banks that issue bank guarantees

Sberbank offers to issue a guarantee in the amount of 50,000 rubles for a period of up to 24 months. The contract is concluded for 3 years with a turnover of large funds.

Commission interest: from 0.49%. Principal's income: up to 400 million rubles. The warranty period is from 1 day.

Alfa Bank calculates the terms and amounts of guarantees only individually for each applicant.

Works only with large and medium-sized businesses; contract currencies may be different. Delivery time: 2-3 weeks.

Tinkoff Bank issues guarantees in the amount of up to 200 million rubles. The contract term is up to 1500 days, the commission is from 1000 rubles.

You can apply without visiting the bank with a personal manager. Issuance period: from 1 day.

The point offers guarantees only for government purchases through Otkritie Bank and Teledoc.

Amount: 10 and 30 million rubles, respectively Commission – from 2%, but not less than 1000 rubles. The contract term is up to 730 days and 25 months, respectively. Delivery time: from 24 hours.

Module bank. This bank also works with small businesses and offers favorable conditions for issuing guarantees.

Amount: up to 11 million rubles. Duration: up to 5 years. Commission: from 1000 rubles. You can sign up for an agreement online. Issue time: within 1 day.

We figured out what a bank guarantee is in simple language. This is an agreement between three parties to ensure the fulfillment of obligations under all points of the agreement. Previously, only large enterprises and government agencies used this service; now small companies and even entrepreneurs use it.

This is a very convenient help for developing organizations and market giants in all areas of activity.

Sincerely, Ilmira Kolodey specially for the proudalenku.ru project

Bank commission and factors influencing the cost of a bank guarantee

Bank fees and factors influencing the cost of a bank guarantee vary by financial institution and over time. The size of the government contract, the presence of collateral, the reliability of the borrower - everything is taken into account when compiling the price of the guarantee. The bank commission is 1.5-5% of the size of the bank account.

The rate if there is collateral in the form of property will be 2.5% of the amount of the guarantee, but not less than 10,000 rubles. With a deposit, the client can count on 1.5%. In the absence of collateral and the ability to open a deposit, the bank provides a rate of 4%.

Bank guarantee fees.

The “issue price” in this case is of no small importance. Each bank sets its own commission. On average for banks, the commission for providing a bank guarantee is:

- 1% of the contract amount if the document is drawn up for a period of up to 90 days.

- 2% - for up to 180 days.

- 3% - for up to 270 days.

- 4% - for up to 365 days.

Author of the article, financial expert

Dmitry Tachkov

Hello, I am the author of this article. I have a higher education. Specialist in finance and banking. Worked in commercial banks of the Russian Federation for more than 3 years. I have been writing about finance for more than 5 years. Always on topic about the best deposits and cards. I make profitable deposits and receive high cashback on cards. Please rate my article, this will help improve it.

about the author

Useless

0

Interesting

2

Helped

4

Documents for obtaining a bank guarantee

When contacting a bank or broker directly, you must collect information yourself. The application, questionnaire, analytical tables are compiled at the bank branch. It is also necessary to prepare constituent documents to obtain a bank guarantee.

The following must be provided: accounting records, tender documentation, a copy of the contract, a draft text of the guarantee, statements of current accounts for the last 6 months. The bank requests copies of passports of the persons responsible for signing the agreement. Banks have the right to require additional certificates.

Advice from Sravni.ru: When concluding a bank guarantee agreement, it is worth consulting with specialists who can check the terms of the guarantee.

Requirements for banks

Since the beginning of 2014, the requirements for banks and organizations capable of issuing bank guarantees have been slightly changed. One of these changed requirements was the size of the authorized capital. Now organizations that were previously involved in issuing guarantees must have 1 billion rubles in their authorized capital. In addition, such organizations must be included in a special list of banks maintained by the Ministry of Finance of the Russian Federation.

The full list of requirements is established in Article 74.1 of the Tax Code, which includes:

- Availability of a license to conduct this operation;

- Availability of capital – 1 billion rubles;

- Compliance with the standards provided for by Federal Law No. 86-FZ;

- Lack of measures taken to ensure the financial recovery of the bank.

Thus, we see that the state, represented by authorized bodies, strictly regulates the activities of banks in this area of legal relations.

If a friend suddenly appeared. Litigation

The meaning of a bank guarantee is precisely that the funds under it must be transferred unconditionally; the debtor cannot object and refuse payment for some reasons that are related to the very essence of the main obligation and the reasons why it was not fulfilled. The beneficiary does not need to file a lawsuit and prove the principal's bad faith, but if the guarantor does not want to pay, he will most likely refuse on formal grounds. The beneficiary will have to go to the arbitration court, and this will require the involvement of a lawyer and payment of a state fee, amounting to about 4% of the amount of the claim. This can be avoided by indicating in the text of the guarantee the possibility of direct debiting of funds from the correspondent or settlement (in the case of an independent guarantee) account of the guarantor.

There is an interesting judicial practice related to the issuance of an unreliable guarantee by a bank. In this case, the customer can file a lawsuit to terminate the contract, but if the contractor fulfills his obligations in good faith, the court will refuse to cancel the contract only on the basis of a “gray” guarantee.

When going to court, the beneficiary can ask not only to pay him the amount specified in the text of the letter of guarantee, but also interest at the average regional bank interest rate, calculated from the date of the request for payment to the date when the money was actually credited to the beneficiary's account.

In the case of tender guarantees, the legislation gives the beneficiary the right not to accept the security, even if prepared in accordance with established standards, and to demand the provision of a document with conditions that suit him better. In any other case, the text of the guarantee will be the fruit of the negotiation process, and the beneficiary can also insist on the inclusion of its conditions in the text of the document or adjustments to existing ones.

Obtaining a guarantee using the services of a broker can sometimes significantly speed up and facilitate this process, and the broker's specialists will help draw up the document so that its acceptance will not be refused. The price of the contract for issuing a guarantee in this case will also include the cost of brokerage services.

What is a bank guarantee and why is it issued?

Bank guarantees are used in international trade, in domestic commercial transactions, and in economic interactions between the state and private companies.

A guarantee is a kind of additional insurance for the customer, which compensates his costs in the event of dishonest work by the contractor.

Example

A little-known but promising private construction company wins the tender for the reconstruction of the central city clinic. The work is large-scale and expensive.

The municipality needs confidence that the work will be completed on time and with high quality. Nobody wants to suffer losses. Therefore, municipal authorities require the company to provide a bank guarantee to secure the contract. The company issues a guarantee in Sberbank and transfers it to the customer.

If the “Foreman” refuses the contract or does not carry out the reconstruction on time, the bank will pay a penalty to the municipality. In the future, the financial institution will recover the money spent from the debtor under the obligations.

Parties to the guarantee transaction:

- beneficiary (customer);

- guarantor (bank or other credit institution);

- principal (executor, debtor of obligations).

In our example, the beneficiary is the municipality, the guarantor is Sberbank, and the principal is the construction company.

How does a bank guarantee (BG) differ from insurance?

Despite all their similarities, there are significant differences between these types of documents:

- They are dealt with by different institutions. Insurance companies, in principle, can issue guarantees, but according to new amendments to the legislation in 2020, such documents cannot be considered bank guarantees. They are called payment guarantees. They will not be accepted as a guarantee for securing government contracts. And this is the most popular area of BG.

- A bank guarantee agreement involves 3 parties, and not 2, as with insurance.

- In the event of a warranty case, the bank acts as a guarantor - it is from it that the customer will demand monetary compensation in the event of failure by the debtor to fulfill its obligations.

- The amount of BG sometimes reaches tens and hundreds of millions. Not all insurers are able to pay for such risks.

The initiator of issuing a bank guarantee is always the principal. He pays commissions, because the bank does not enter into an agreement free of charge. A financial institution needs confidence in the client’s reliability, so they do not issue guarantees to everyone. The company must be solvent, stable, successful, and preferably experienced.

It seems that guarantees are needed only by customers of services, but in reality this tool is beneficial to all parties to the transaction.

Advantages of BG:

- financial savings for the contractor - he does not need to freeze working capital in his account to secure the contract;

- with bank guarantees, companies have the right to participate in an arbitrary number of tenders;

- the principal receives an additional incentive to fulfill his obligations efficiently and on time;

- The guarantee is issued faster than a loan, and the interest on payments is tens of times less.

Among other things, potential partners have more confidence in companies that use bank guarantees. For small private companies, BGs open the way to major deals and lucrative long-term contracts.

A couple of years ago, registering a BG was much easier. Almost all banks worked in this direction, although the quality of such services often caused criticism. In 2020, with the entry into force of the new law, the number of financial institutions eligible to register a BG decreased sharply.

According to the new legislation, BGs are issued only by those banks that are on the official list of the Ministry of Finance of the Russian Federation. The main criteria for selecting banks by the Ministry of Finance are the size of the authorized capital (it must be more than 1 billion rubles) and the absence of claims from the Central Bank.

It is very easy to find out whether a candidate bank is on the list - information is available on the official website of the Ministry of Finance.

The official website of the Ministry of Finance of the Russian Federation will tell you whether your bank has the right to issue a BG

At the same time, the guarantees themselves, which are written agreements, are drawn up in accordance with strict requirements and must be entered into the state register, which confirms the authenticity of these documents.

Read a separate detailed publication on our website about what a bank guarantee is.