Other

When an entrepreneur switches to a single tax on imputed income (UTII), as well as when filling out a declaration

2020-08-03 1722 The easiest way to organize accounting documentation and eliminate errors in it is

Briefly about the regulatory framework The financial liability of the employee and the employer is established in three chapters of the section

Hello, Vasily Zhdanov, in this article we will look at a basic concept in financial analysis:

Some organizations reward their employees with additional monetary rewards - the so-called 13th salary. What

In what cases is VAT paid? The simplified taxation system is a convenient way to keep records for

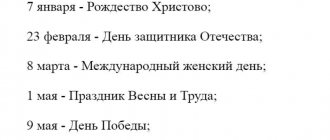

New edition of Art. 153 of the Labor Code of the Russian Federation Work on a day off or a non-working holiday is paid

Grounds and reasons Article 76 of the Labor Code of the Russian Federation lists situations in which an employee must be suspended

Personal income tax rate on dividends Before 2020, tax on dividends had to be withheld at

Depreciation of fixed assets in accounting and tax accounting In the process of use, fixed assets lose their