Changes

Remuneration of employees is regulated by the Labor Code (Section VI) and Federal Laws. Since 2020, amendments to the code have come into force, obliging the employer to calculate and pay wages every 15 days. This eliminates the concept of an advance; it is now the first part of the salary.

The legislator does not set dates within which the employer is obliged to give employees the money due for work. This remains at the discretion of the administration, but taking into account the new requirements, a certain interval must be maintained between the payment of parts of the salary.

What is salary according to the Labor Code

The term “salary”, as well as the accompanying definitions “basic salary”, “official salary” and “wages” are deciphered in Art. 129 Labor Code of the Russian Federation. To understand how to calculate the salary from the salary and apply the appropriate formula, let’s understand these terms:

Based on the definitions given in the Labor Code of the Russian Federation, salary is the minimum fixed amount of money that the employer is obliged to pay to the employee for each month worked, subject to the fulfillment of the job duties assigned to him.

Recommendations from ConsultantPlus experts will help you check whether you have set the salaries of your employees correctly. Get free access to the system and go to the Ready-made solution.

Salary is a more expanded concept, which includes, in addition to salary, various additional payments, bonuses and bonuses to which an employee is entitled.

Salary and wages are the same in value if for a fully worked billing month the employee, in addition to the salary, is not accrued compensation and incentive payments.

Wages can be calculated not only on the basis of salary, but also on the basis of the tariff rate - a fixed amount of remuneration for fulfilling a standard of work of a certain complexity per unit of time (hour, day, decade, month) without taking into account compensation and additional payments.

The formulas for calculating wages based on salary and based on the tariff rate are different. Next, we will tell you how to correctly calculate salary based on salary.

Payroll in 2020

Innovations in 2020 regarding the calculation and payment of wages to employees are reflected in Federal Law No. 272-FZ of July 3, 2020 and relate to Article 136 of the Labor Code of the Russian Federation. Verbatim this article now reads like this:

Salaries are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued.

Following this rule, the employer is obliged to pay earned money to its employees at least twice a month with an interval of no more than 15 calendar days. The organization itself sets the payment schedule, but within a time period. At the same time, there is a need to fix these terms in a collective or employment agreement.

For example , an enterprise sets the date for issuing salaries on the 6th, then the advance must be paid no later than the 21st. If you issue an advance before this period, the requirement of the Labor Code regarding payment of the final payment for the month will be violated. The time gap will then be more than 15 days.

It is acceptable in large organizations to establish different dates for the payment of wages for structural divisions. For example, for workers in primary production, the payment schedule is defined as the 1st and 16th of each month, and for administrative workers - on the 5th and 21st.

Premium payments

To encourage work efficiency under any remuneration system, the company's management may provide bonuses and allowances for various indicators: implementation of the plan, high quality, etc. The procedure for their accrual is established by a collective agreement, bonus regulations or other local act of the organization.

How to calculate wages taking into account incentive accruals depends on the procedure for their calculation. They can be set as a percentage of the tariff rate (salary) or in absolute value. The total amount accrued for time worked is calculated as follows:

New salary calculation in 2020

It is established by law that the salary of a citizen working under an employment contract cannot be less than the national minimum wage. From January 1, 2020, the minimum wage amounted to 12,130 rubles and became equal to the subsistence level from May 1, 2020. This means that with fully worked allotted time per month, the employee can receive no less than this amount.

It is important to note that this rule does not apply to part-time workers, and they will receive the payment due in proportion to the time worked.

The minimum wage is the value below which the calculated salary cannot be. Minus taxes and obligations under writs of execution, it will be clearly less. At the same time, the minimum wage is not the size of the salary, but the total amount together with other remuneration in the form of bonuses, allowances and other additional payments. The exception is the coefficients for residents of the northern regions, as well as premiums, they are calculated from above.

As for the division of amounts that are the first and second parts of the salary, personal income tax should be taken into account in each case. As a result, it turns out that with a two-time payment, the first part is 43.5% of the total amount for the month under normal conditions.

What else is paid besides personal income tax?

The law provided for the amount of tax. In most cases, personal income tax should not take more than 20% of his salary out of an employee’s wallet. There are exceptions. In total, the tax should not be more than 50%.

There are other taxes, or deductions, that the law imposes on wages. However, their payment is not the responsibility of an ordinary employee. The employer bears this burden.

In addition to personal income tax, a social security contribution is made in the amount of 2.9%. Monthly amounts are also transferred to the Pension Fund. Their size is 22%. Compulsory health insurance takes 5.1%.

For everyone who is residents of the Russian Federation, the tax rate for labor activities does not exceed 13%. The same percentage is paid by non-residents classified as citizens of EAEU countries, visa-free immigrants, refugees and highly qualified specialists. All other persons who are not residents of our country pay personal income tax in the amount of 30%.

It is expected that in the near future the tax will be increased to 16%. However, the State Duma is postponing resolution of this issue for now. It is not yet known whether it will be considered.

Some categories of employees (notaries, lawyers, individual entrepreneurs, etc.) are themselves required to pay taxes on their activities.

By learning how to calculate your salary, you can plan your expenses and make plans for the future. Many enterprises have such concepts as progressives, bonuses, overtime, etc. The more savvy you are, the easier it is to change your life for the better. The ability to calculate salaries correctly will not hurt anyone.

Top

Write your question in the form below

How to calculate salary using formula

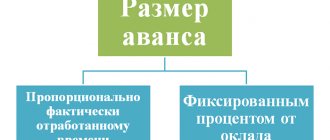

The Labor Code does not establish rules for calculating parts of the salary, but referring to the explanations of the Ministry of Labor, we can conclude that the calculation of the first part includes not only the salary, but also all allowances and additional payments established for the employee. The monthly amount is distributed in proportion to the days worked.

To calculate the advance:

- The number of days worked in this part of the month is determined. If the employee was on vacation or sick leave, then these days are not taken into account in the calculation.

- Take into account all charges. This includes salary, bonuses, additional payments, including for the additional amount of work that was established this month, night shifts, etc. Using only the salary amount for calculation will entail the imposition of fines on the employer.

The following accruals are not taken into account when generating the advance calculation:

- A monthly bonus, which is awarded based on the results of work for the month.

- Payments that are of an incentive nature based on the results of work for the month.

The formula for calculating wages for the period that the employee actually worked in the current month is as follows:

(Salary + Additional payments and allowances + Bonus payments) / Number of working days in a month × Days worked

For each monthly payment, the accounting department calculates deductions, minus which the amount will be given to the employee. The standard deduction is personal income tax, amounting to 13% of income. Additionally, amounts for writs of execution and trade union dues can be deducted from the salary.

Bonus payments can be established after the first payment of earnings due. Then they will be calculated in the usual way and the second payment, the so-called final payment for the month, will be the difference between the calculated salary for the entire month using the bonus and the first payment (usually called an advance).

Where do wages go?

We calculate salaries correctly

So, you've been hired. An order was issued in this regard and an employment contract was signed. A corresponding entry has been made in your work book. Based on the submitted documents, the company’s accounting department has opened a personal account in your name. You are working and full of expectations.

To avoid disappointment with the amount of earnings paid, every employee must understand that in most cases, when announcing vacancies, it is not the amount that a person will receive in hand that is indicated, but what will be initially accrued. Deductions are not shown, since from the point of view of the law, the basic amount is taken for the salary.

Salary is what you will receive when all legally required interest has been deducted from your salary. In Russia they are not as ruinous as in many other countries. In some states, the treasury takes away more than 50% of people's honestly earned money. This is needed to cover social needs, defense, maintenance of government agencies, etc.

What amounts will not be included in the salary that the employee receives at the end of the month. It can be:

- contributions to social services;

- unworked days for which no one is obliged to pay you;

- alimony;

- advances;

- taxes that the state levies on individuals, etc.

The salary will change every month. And there is nothing illegal about this.

Those who feel most comfortable are those who understand the question of “what’s what” and can calculate their pay themselves. This is useful, since accountants can make mistakes: knowing that you are savvy in this matter, they will be more attentive.

The salary is not the salary that the employee receives in person after the accounting department has made all the necessary deductions.

Calculation example

Let's look at a few typical payroll situations.

Example 1.

The employee's salary is set at 25 thousand rubles. This month he was given an additional bonus for replacing an absent employee and an additional amount of work of 50% of the salary. There are 21 work shifts in a month. From the 1st to the 15th there will be 11 work shifts.

The first advance payment is calculated as follows:

(25000 + (25000 × 50 %)) /21 × 11 = 19643 rubles.

Second payment “Salary”:

(25,000 + (25,000 × 50%)) / 21 × 10 = 17,858 rubles. (we calculate the remaining 10 shifts worked)

(19643 + 17858) × 13% = 4875 rubles (we calculate personal income tax from salary)

Minus 13% personal income tax, he will receive: 17858 - 4875 = 12983 rubles

Example 2.

Let’s take the same situation, but in the second half of the month the manager signed an order to provide bonuses to the team in the amount of 25% of the salary.

Then the second payment will be:

(25,000 + (25,000 × 50%) + (25,000 × 25%) – 19,643 (received in the first half of the month) = 24,107 rubles – 13% (personal income tax) = 20,973 rubles in hand.

Example 3.

Additionally, the employee worked 2 shifts overtime. When calculating the advance, overtime work is not taken into account, but at the end of the month they must be accrued and issued in the final payment. The advance will be the same as we discussed above, and the second payment will be larger due to the number of hours worked overtime. The following rule is used:

the hourly rate for the first two hours of such work increases 1.5 times, and subsequent hours are paid double.

Use a convenient online payroll calculator

Types of wages

It will be useful to know how wages are calculated. There are two types of it: piecework and time-based. Your task is to decide which of the two types your type of income belongs to.

Time-based depends on the time you worked. That is, it is calculated depending on the hours worked. Each enterprise has a special employee who is obliged to keep records of how much each of the team members on the staffing table works. All information about the work is entered into the working time sheet. The time taken into account is divided into categories. There is night and holiday. Work at night and during holidays is paid differently. The timesheet contains all the information about what the employee did during working hours.

If you were sick or on vacation, the appropriate notes are made in the document.

The time-based salary is directly dependent on how much you worked and how you used the time taken into account in your timesheet, whether you were at your workplace or went on a business trip.

Piece payment depends on the amount of work performed. In this case, the basis for accrual is not time, but the prices agreed upon by management and employees.

If teams are involved in production, wages are calculated for everyone, and then the foreman decides who is entitled to what amount. Typically, the volume completed by each team member is taken into account. With piecework calculation, workers always know how much they should receive.

Enterprises use either piecework or time-based wages. The first can be paid directly to the brigade.