Comparing sizes in 2020 and in 2020

Minimum benefit for BIR in 2020

If maternity leave began in 2020, then the minimum average daily earnings for calculating maternity benefits was 311.97 rubles. If actual earnings were below the minimum, then benefits had to be calculated from this value. Here are the minimum amounts of maternity benefits in 2020:

Minimum benefits under BIR in 2020: new values

The “minimum wage” in 2020 is considered similarly. However, new amounts of average earnings are already being accepted.

How to correctly calculate your return to work date?

Calculation of the end date of maternity leave to care for a baby is carried out according to a simple scheme. As soon as the child turns three years old, on the next working day the woman is obliged to start working at the enterprise where she is registered.

This period is not affected by what kind of birth the woman had, complicated or not. If an employee decides to interrupt her vacation and go back to work, then she will need to write a statement indicating the date when she is ready to start work.

If a woman decides to leave the B&R leave earlier than the established period, then she should close her sick leave with a doctor. In this case, the date of return to work will be indicated in the certificate of incapacity for work.

Indexation of maternity benefits from February 1, 2019

In 2020, some child benefits must be indexed from February 1 to a coefficient established by the government. Indexation applies to the following benefits paid by the employer:

- a one-time benefit for women who registered in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance.

As you can see, indexation does not concern the amount of maternity benefits (in particular, the minimum amount). Therefore, even after February 1, 2020, the minimum maternity benefit will not change.

Below in the table we present the values of the minimum benefit from January 1, 2020.

| Minimum maternity benefit from 2020 | |

| in general | RUB 51,918.90 |

| during multiple pregnancy | RUB 71,944.76 |

| during complicated childbirth | RUB 57,852.49 |

The situation with child benefits, as well as maternity benefits, changes every year. The Motherhood portal publishes information on financial support for mothers with children in 2019.

One-time benefit for women who registered early

You must provide the employer with a certificate issued at the antenatal clinic/medical center and an application for granting benefits.

Maternity benefit for pregnancy and childbirth

working at the place of work, non-working citizens (registered with the Social Security authorities)

100% of the average monthly salary. For the unemployed, the minimum allowance is 632.76 rubles/month.

The minimum wage for working women

43615, 65 -140 days of maternity leave;

48600, 30 - complicated childbirth with sick leave for 156 days;

60438, 83 - multiple pregnancy with 194 days of sick leave.

The maximum a woman can receive (calculated based on the size of the insurance base

282106, 70 - regular sick leave for 140 days;

314347, 47 - sick leave for complicated childbirth;

390919, 29 - sick leave for multiple pregnancy.

One-time benefit for the birth of a child

monthly benefits for caring for a newborn up to 1.5 years old

4512—for the first child, 6554.9—for the second and subsequent children

Maximum maternity benefit

Minimum maternity benefit

Additional payments in Moscow for single mothers

Monthly child benefit for families whose level of property security does not exceed the level of property security for the provision of social support measures for low-income families, established by the Moscow Government, and whose average per capita income does not exceed the subsistence level established by the Moscow Government per capita

— for children aged from birth to 3 years:

— for children aged 3 to 18 years:

- single mothers (fathers), military personnel undergoing military service on conscription, a parent evading payment of alimony - 6,000 rubles

- in other families - 4000 rubles

Monthly compensation payment to compensate for the increase in the cost of food for children under 3 years of age.

Monthly compensation payments to reimburse expenses due to the rising cost of living for certain categories of families with children. Provided for children under 16 years of age (students under 18 years of age).

— 750 rubles – with income below the subsistence level in Moscow (receiving a monthly child benefit)

— 300 rubles – with income above the subsistence level in Moscow (those who do not receive monthly child benefits)

Low-income families are also eligible for additional benefits, which are discussed in this article.

- What maternity payments can an individual entrepreneur receive and in what order in 2020?

- Payments, preferences and benefits for individual entrepreneurs during pregnancy and after the birth of a child, which a woman individual entrepreneur will receive, regardless of payments or their absence in the Social Insurance Fund

- Payments and benefits for women individual entrepreneurs on maternity leave, the receipt of which requires prior payment to the Social Insurance Fund

- How are maternity payments made if the individual entrepreneur is also employed as an employee?

- How to calculate the amount of insurance premiums for an individual entrepreneur

- What influences the amount of payments to individual entrepreneurs on maternity leave in 2020

- What requirements must be met in order for an individual entrepreneur to receive all state-authorized maternity payments:

Expert opinion

Zakharov Vasily Vladimirovich

Practicing lawyer with 6 years of experience. Specialization: family law. Legal expert.

The legislation provides for maternity leave for women who carry out their work activities by registering as an individual entrepreneur.

In addition, the state grants a woman entrepreneur the rights to:

- payment of sick leave due to temporary disability;

- receiving cash payments in connection with pregnancy and childbirth;

- one-time payment upon registration at the antenatal clinic in the first months of pregnancy;

- payment of additional funds in connection with the care of a newborn child;

- child care and supervision allowance, which is paid every month until the child reaches 1.5 years of age.

It is important to remember that currently maternity leave includes various periods, such as:

- leave due to pregnancy and childbirth;

- leave for one of the child’s parents, usually the mother, to care for him for 1.5 years from the date of birth;

- leave for one of the child’s parents, usually the mother, to care for him for 3 years from the date of birth.

The current labor standards regarding maternity leave for women engaged in entrepreneurship and women employed have distinctive features and similarities.

Billing period

To determine the amount of child care benefits up to 1.5 years old, you first need to decide: earnings for what period to take for calculation. As a rule, the calculation period is taken to be two calendar years preceding the start of parental leave. Or rather, the number of calendar days in them.

For example, in the calculation period for benefits for an employee who took leave in 2020, use 2014 and 2020. That is, in the general case, 730 days (365 days + 365 days).

From the calendar days of the billing period, exclude:

- periods of temporary disability, maternity leave and child care leave;

- the time when an employee was released from work with full or partial retention of salary, if insurance premiums were not calculated from salary.

This is stated in parts 1 and 3.1 of Article 14 of the Law of December 29, 2006 No. 255-FZ and is confirmed by the letter of the FSS of Russia dated January 11, 2013 No. 15-03-18/12-169.

An example of determining the calculation period for paying child care benefits up to 1.5 years. The employee had calendar days excluded from the pay period

Secretary E.V. Ivanova is going on maternity leave from September 2, 2020.

In 2020, from March 15 to March 28 (14 calendar days), Ivanova was sick and received temporary disability benefits.

The calculation period for payment of benefits for child care up to 1.5 years will be from January 1, 2014 to December 31, 2015.

The duration of the billing period will be 716 calendar days (730 days - 14 days).

It happens that two previous years or one of them is replaced by even earlier ones. This is done if these periods were non-working periods, for example, the employee was on maternity leave. Periods are replaced at the request of the employee and on the condition that this will lead to an increase in benefits. This is stated in Part 1 of Article 14 of the Law of December 29, 2006 No. 255-FZ and paragraph 11 of the regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

The billing period can only be replaced by those years (year) that immediately precede the occurrence of the insured event. For example, a woman was on maternity leave or child care leave in 2014–2015, and a new insured event occurred in 2020. Then 2014 and (or) 2020 can only be replaced by 2013 and (or) 2012. You cannot take any years that were before 2014–2015.

Such clarifications are given in the letter of the Ministry of Labor of Russia dated August 3, 2020 No. 17-1/OOG-1105.

What if the employee was first on maternity leave and then on parental leave for up to three years in the period from 2012 to 2020? Then, to calculate benefits, you can take 2011 and 2010. At the same time, there is no need to recalculate benefits that were assigned and paid before the release of the letter of the Ministry of Labor of Russia dated August 3, 2020 No. 17-1/OOG-1105.

Such clarifications are given in letters of the FSS of Russia dated November 11, 2015 No. 02-09-14/15-19989 and No. 02-09-14/15-19937, dated November 9, 2015 No. 02-09-14/15- 18677.

When replacing, calculate the benefit in the same way as in the default calculation period - based on the actual number of calendar days in years. This conclusion follows from Part 3.1 of Article 14 of the Law of December 29, 2006 No. 255-FZ and is confirmed by information from the Federal Social Insurance Fund of Russia.

Situation: is it possible to replace calendar years with earlier ones to calculate child care benefits if the employee took maternity leave from another employer? She got a job at the organization this year and is going on maternity leave this same year.

Yes, you can. But only if certain conditions are met.

There is no restriction on replacing one or both years in the pay period only with periods when the employee worked for the last employer. However, several conditions will still have to be met. Namely:

- as a result of the replacement, the amount of the benefit should increase (part 1 of article 14 of the Law of December 29, 2006 No. 255-FZ and clause 11 of the regulation approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375);

- the employee must present documents that confirm, firstly, the time when she was granted maternity leave, and secondly, the amount of earnings in those years that will be replaced during the billing period.

If everything is clear with the first condition, then with the second it is not so simple. We'll tell you.

In general, upon dismissal, the employee should have been given a special certificate. It precisely confirms the amount of payments to the employee, as well as the periods when she was on maternity leave (clause 3, part 2, article 4.1 of the Law of December 29, 2006 No. 255-FZ, clause 1 of the Procedure set out in Appendix 2 to the order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n).

However, the certificate is issued only for the last two years of work. The previous employer is not required to issue a certificate for earlier periods (clause 3, part 2, article 4.1 of the Law of December 29, 2006 No. 255-FZ). Without such a certificate for earlier periods, it will not be possible to obtain accurate information for calculations.

What to do in this situation? Some of the necessary information can be obtained from the Pension Fund of the Russian Federation. As a result, you will be given information in a special form. But it will only contain the total amount of the employee’s earnings. Information about those days that need to be excluded from the billing period is not provided in the form.

So it turns out that only the previous employer can become a full-fledged source of information necessary for calculating benefits. This means that if an employee wants to transfer years from the payroll period, she will have to negotiate with him. If this succeeds, then the former employer can provide her with the necessary information, supplementing the certificate for the last two years. To do this, he can add additional lines to the form. The procedure for issuing it, set out in Appendix 2 to Order No. 182n of the Ministry of Labor of Russia dated April 30, 2013, does not prohibit this. This conclusion follows from the letter of the FSS of Russia dated July 24, 2013 No. 15-02-01/12-5174l.

An example of an employee submitting documents for calculating childcare benefits for a child up to 1.5 years old. In the period preceding the year the parental leave began, the employee was on maternity leave with another employer

Employee of the organization E.V. Ivanova got a job at the company in February 2020 and went on maternity leave that same year. In 2020, she worked in another organization, where she was granted maternity leave.

The calculation period for calculating child care benefits includes 2014 and 2020. However, in 2020, the employee was on maternity leave. Therefore, Ivanova asked to replace the 2020 billing period with 2013, which she fully worked out. Thus, the childcare benefit for a child up to 1.5 years old for an employee will be calculated based on earnings for 2013 and 2014.

Since Ivanova left her previous employer in 2016, upon dismissal, the previous employer gave her a certificate of the amount of earnings for 2014 and 2020.

To replace the corresponding period (2015) with the previous calendar year (2013), Ivanova submitted the following documents to the organization:

- application for the transfer of one year of the calculation period (from 2015 to 2013);

- a certificate of the amount of earnings from the previous place of work for 2013.

Ivanova submitted a certificate of earnings for 2014 and 2020 earlier - when she was hired in February 2020.

Situation: is it necessary to recalculate benefits if an employee took annual paid leave during maternity leave?

The benefit will have to be recalculated only if the interrupted parental leave begins next year. After all, then to calculate benefits you will need to take earnings for other years - the calculation period will shift.

In order to interrupt parental leave, the employee writes a statement. When he decides to resume the interrupted vacation, the monthly allowance must be assigned again. The explanation is simple - the amount of benefits must be determined at the time of the insured event. That is, when maternity leave will be resumed.

So it turns out that if the vacation was resumed in the same year for which the benefit was already calculated, then there is no need to determine its amount again. And vice versa, if parental leave for a child up to 1.5 years old begins next year, then to calculate the benefit you will need to take earnings for a different period. Of course, if the employee does not write an application to postpone the billing period to the same years for which the benefits were previously calculated. Then again you won’t have to recalculate the benefit.

To make it clearer, let's look at all three options using examples.

Maternity leave resumed next year

The employee has been on maternity leave since February 20, 2020, but works part-time. The calculation period is 2013 and 2014. On February 1, 2020, the employee interrupts her maternity leave and goes on annual paid leave for 14 calendar days. As of February 15, 2020, parental leave has been resumed. Child care benefits have been re-assigned. At the same time, the calculation period changed to 2014 and 2020. Therefore, the benefit must be recalculated.

Parental leave will be resumed next year. The employee exercised the right to transfer the pay period to previous years

The employee has been on parental leave since February 20, 2020, but works part-time. The calculation period is 2013 and 2014. On February 1, 2020, the employee interrupts parental leave and goes on annual paid leave for 14 calendar days. As of February 15, 2020, parental leave has been resumed. Child care benefits have been re-assigned. At the same time, the employee asked to replace the years preceding the year of resumption of leave (2014 and 2015) with 2013 and 2014 for the purpose of calculating benefits. Since in the end the billing period remained the same, there is no need to recalculate the benefit.

Maternity leave resumed the same year

The employee has been on maternity leave since February 20, 2020, but works part-time. The calculation period is 2014 and 2020. On April 1, 2020, the employee interrupts her maternity leave and goes on annual paid leave for 14 calendar days. On April 15, 2016, parental leave was resumed. Child care benefits have been re-assigned. Since the billing period remained the same - 2014 and 2020, there is no need to recalculate the benefit.

All this follows from parts 1 and 3.1 of Article 14 of the Law of December 29, 2006 No. 255-FZ and letters of the FSS of Russia dated July 14, 2014 No. 17-03-14/06-7836, dated January 11, 2013 No. 15 -03-18/12-169, Rostruda dated October 15, 2012 No. PG/8139-6-1.

Please note that if an employee has been on parental leave for more than one year, the benefit must be indexed.

How are maternity payments made if the individual entrepreneur is also employed as an employee?

In a situation where an individual entrepreneur is also employed as an employee, maternity benefits can be received twice - at the place of work and from the Social Insurance Fund as an individual entrepreneur.

With regard to payments until the child is one and a half years old, the situation is different; these payments will have only one source and only one of the spouses will be able to receive them.

Recommendation. Due to the fact that legislation changes quite often, to clarify the procedure and amount of maternity payments, it is advisable to contact local government agencies that handle issues of social protection of the population.

In what cases is it calculated from the minimum wage?

Monthly benefits up to 1.5 years are calculated from the minimum wage in the following cases:

- If the employee had no income .

- If the actual average earnings are below the minimum wage .

In the first case, the average daily earnings are determined by the formula:

In the second case, when calculating average monthly earnings, you should compare the resulting value with the current minimum wage. If the value is lower, the benefit is calculated based on the minimum wage. In any case, the final benefit amount should not be lower than the minimum established by law.

Example, if the experience is less than 6 months

The right to parental leave is not limited by length of service. However, length of service not exceeding six months significantly affects the calculation of benefits.

Example conditions:

On March 1, 2020, the employee is granted parental leave with payment of the required benefits.

Considering that this is her first place of work, the employee’s length of service at the time of the insured event is 3 months. and 6 days, which is less than the legal minimum.

In this case, the monthly benefit for up to 1.5 years is calculated based on the minimum wage.

The employee did not exercise the right to register temporary disability due to pregnancy and childbirth, and therefore the benefit is calculated from the date of birth of the child, that is, from March 1.

The calculation will look like this:

9,489 rubles *24 /730 = 279.09 – average daily earnings.

In this case, the leap year is not taken into account, since one more day in the year does not affect the size of the minimum wage.

We compare the daily income received with the minimum: 279.09 is less than 311.97, so we use the minimum wage rate for the calculation.

Benefit = 9489 * 40% = 3795.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

We compare with the limit values. The employee has her first child, 3795 is more than 3142.33 rubles, which means the amount of her benefit will be 3795.00 rubles.

Example for low income

An employee’s salary cannot be less than the minimum wage (Article 133 of the Labor Code of the Russian Federation). But when calculating benefits, errors are common when the average monthly income is less than the minimum wage.

In this case, the benefit is calculated from the minimum wage.

9489*40%= 3795 rubles.

How to calculate the amount of insurance premiums for an individual entrepreneur

The basic value for calculating the amount of insurance premiums for individual entrepreneurs is the minimum wage. Currently it is 11280.0 rubles. To determine the amount of insurance premiums for the year, you need an approved minimum wage x 2.9% x 12 months. The annual amount of insurance premiums will be 3925.44 rubles.

You can pay in one payment or in several amounts.

Important! The entire amount must be transferred before the end of the year. Otherwise, the contractual relationship with the Social Insurance Fund will be automatically canceled .

What laws and regulations should be followed when considering issues regarding maternity payments to individual entrepreneurs?

- Federal Law dated December 29, 2006 No. 255-FZ

- Federal Law dated May 19, 1995 No. 81-FZ

- Decree of the Government of the Russian Federation dated October 2, 2009. No. 790

Rules and formulas for calculation

To calculate a monthly maternity benefit for a child up to 1.5 years old, you first need to calculate the average daily earnings for the last 2 years, then compare it with the permissible limits, and then calculate the amount of the benefit.

The formulas for calculation are as follows:

Benefit up to 1.5 = 40% * Average daily earnings * 30.4 (30.4 is the average monthly number of days).

Average daily earnings = Income for 2 years / (Number of days in 2 years - Excluded periods).

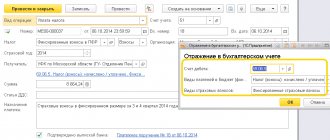

In general, the calculation algorithm is as follows:

- The accountant sets the billing period and counts the number of calendar days in it.

- It is determined whether there is a right to replace the accounting years.

- The presence of excluded days is checked.

- The total income for 2 years is calculated.

- Average daily earnings are calculated.

- The resulting value is compared with the minimum and maximum.

- A monthly allowance is considered.

General rules and important nuances are set out in Article 14 of Law 255-FZ.

What influences the amount of payments to individual entrepreneurs on maternity leave in 2020

The amount of monthly payments is determined based on the accepted minimum wage. In addition, the period during which the individual entrepreneur made contributions to the Social Insurance Fund and/and how long the individual entrepreneur carried out her labor activity as an employee is important. This period, as a percentage of the current minimum wage, will determine the amount of benefits.

Pregnant women have special benefits at work; they are protected and supported by the state. Payments are made from the social insurance fund. But the situation with an individual entrepreneur may change, since the individual entrepreneur himself does not have the right to receive benefits.

Calculation of benefits for an incomplete month

Rarely, the benefit is issued on the 1st day of the month and ends being paid on the last day of the month. Therefore, the task arises of calculating benefits for an incomplete period.

The benefit for an incomplete period is calculated as follows: you need to multiply the benefit amount by the number of days for which it must be paid and divide by the number of calendar days in the month.

For example, the benefit was accrued in the amount of 15,000 rubles. The woman took a leave from July 11, she must be paid for 20 days. There are 31 days in July. The calculation will look like this: 15000/20/31=9677.42 rubles.

Are maternity benefits required for individual entrepreneurs?

The laws of the Russian Federation do not clearly define whether an individual entrepreneur should interrupt his work activity during maternity leave. There is no concept that a woman who has given birth or is pregnant should stop working and lose benefits while on statutory leave.

The condition applies even if the individual entrepreneur has no employees other than the owner himself.

Note! Individual entrepreneur and maternity leave are concepts bound by law, since in fact a person must make payments to the Social Insurance Fund in order to receive paid maternity leave.

But if an entrepreneur needs to suspend his activities, he can do so. A pause in work is not a type of liquidation, since the break is taken for a certain time, and entrepreneurship does not stop forever.

Expert opinion

Zakharov Vasily Vladimirovich

Practicing lawyer with 6 years of experience. Specialization: family law. Legal expert.

There will be no need to make transfers to the pension fund during the entire maternity leave with the IP suspended. But other payments will have to be made in the standard manner without benefits or concessions.

Important! The suspension of transfers to the Pension Fund is valid only if the individual entrepreneur is not working. If the business operates in a standard mode, then UTII and other fees must be paid according to established rules, including transfers to the Pension Fund.

In order for an individual entrepreneur to go on maternity leave, it is necessary to go with a sick leave certificate to the nearest branch of the Social Insurance Fund, attaching the necessary package of documents for consideration of the application. This opportunity is valid only for those entrepreneurs who paid for the Social Insurance Fund on a voluntary basis.

Note! Suspension of business is a woman’s right, not an obligation. Therefore, whether to stop the case or not is a question decided by the individual entrepreneur himself.

Then the FSS will check the fact of maternity leave within 10 days after the application. Funds are paid until the 26th of the next month after verification. The choice of delivery of funds is chosen by the applicant himself. This can be by postal or bank transfer, cash.

Regardless of whether an individual entrepreneur has subordinates, there will be practically no difference in the design scheme and in other aspects. But if an individual entrepreneur with employees stops doing business for a while due to maternity leave, then the entrepreneur is obliged to fire all employees and pay them all due salaries and compensation.

How to calculate the duration of rest

The employer is obliged to provide the employee with the number of days she needs within the annual duration of the paid period. Calculation is needed to understand what part of this rest is provided on account of the existing experience, and what part is provided in advance.

Here are instructions on how to calculate the vacation period after maternity leave:

- Determine the total duration of the employee’s work in the organization.

- Establish periods that allow you to rest - they are listed in Art. 121 Labor Code of the Russian Federation.

- Calculate the number of days that the employee purchased for each of these periods and add them together.

An employee is given the right to paid rest: periods of direct work, including periods of regular vacations and sick leave, and labor and employment. Parental leave is not counted towards the length of service for receiving annual rest, except in cases where the employee works part-time without leaving the UM.

With a standard annual rest period of 28 days, a full month gives 2.33 days. If less than two weeks are worked in a calendar month, it is not counted towards the length of service; if more, it is counted.

How to receive benefits when going on maternity leave

Legislation allows individuals who are individual entrepreneurs to take maternity leave and receive appropriate benefits for this. To do this, he will need to draw up an application and submit it to the Social Insurance Fund to register and receive funds in a fixed amount.

Voluntary registration leads to the possibility of receiving insurance coverage only if the individual entrepreneur made contributions for the previous year.

Important! The amount of social security is determined depending on the minimum wage.

To receive benefits, an individual entrepreneur must follow a certain algorithm of actions:

- Draw up an application containing a request for payments in connection with pregnancy.

- Attach a package of documents.

If an individual entrepreneur has another official place of employment, then he can choose how to formalize the receipt of funds from the state. The first is to contact the FSS yourself. The second is to contact your employer.

Benefit calculation examples

For clarity, we provide examples of calculations of child care benefits for children up to 1.5 years old.

Example 1. A citizen applies for parental leave in 2020. For 2020, her earnings amounted to 500 thousand rubles, for 2020 - 450 thousand rubles. The indicated values are less than the limits of 755 and 718 thousand rubles, therefore they can be taken into account in the calculations in full. Over the two years under review, the citizen was on sick leave for 34 days.

The calculation of the average daily earnings for her will look like this: (500,000 + 450,000)/ (730-34) = 1364.94 rubles. This value is less than the limit of 2020.81 rubles, so it is allowed to take it into account in full without reduction.

Finally, you can calculate the amount of child care benefits up to 1.5 years old, which will be transferred to the woman monthly. It will be: 1364.94*30.4*40%=16597.7 rubles.

Example 2. A company employee earned 986 thousand rubles in 2017, and 855 thousand rubles in 2020. These values are greater than the established limits for 2016-2017 in the amount of 718 and 755 thousand rubles, therefore only the maximum earnings values will be included in further calculations.

The employee was on sick leave for 15 days. The calculation of average daily earnings will look like this: (718000+755000)/(730-15)=2060.13 rubles. This is more than the maximum average daily earnings in 2020.81 rubles. A woman is entitled to a maximum child care allowance of 24,536.57 rubles.

Example 3. An employee gave birth to twins and wrote an application for maternity leave. In 2020, her income amounted to 98 thousand rubles, in 2020 – 150 thousand rubles. This is less than the limits. She did not use sick leave.

Average daily earnings will be calculated as (150000+211000)/730 = 339.73 rubles.

The benefit for caring for the first child will be 339.73 * 30.4 * 40% = 4131.12 rubles. This value is less than the calculated minimum wage benefit from May 2020. Therefore, for caring for the first child, a woman will receive 4465.2 rubles.

The allowance for caring for a second child will also be paid in the minimum amount, namely 8930.4 rubles. It turns out that a woman will simultaneously care for two children, so she will receive monthly (4465.2 rubles + 8930.4 rubles) = 13395.6 rubles.

In what cases are payments not available?

Maternity payments to individual entrepreneurs are divided into two groups:

- One-time. This is a payment upon registration at the antenatal clinic; its amount will be 655.49 rubles*.

Additionally, regional and federal benefits are paid.

You may not receive payment in several cases:

- an application has not been submitted to the FSS

- an incomplete package of documents was submitted;

- the husband already receives payments on similar grounds;

- There have been no transfers to the social fund over the past year.

When is the minimum wage taken?

The minimum wage for calculating care benefits for up to 1.5 years is taken in the following cases:

- Earnings for the last 2 years on average per month are below the minimum wage;

- there is no income in the 2nd billing period;

- work experience does not exceed six months.

In these cases, the benefit for a full month is 40% of the minimum wage for the first child, and for the second or subsequent ones - the minimum value for the unemployed, from February 1, 2020 = 6554.89 rubles.

If the work experience is less than 6 months, the following condition must be met: for a full month, the employee should not receive more than the minimum wage. Examples of calculations for less than six months of experience can be found here.

Why else do you need to register with the FSS?

The obligation of insurance in the Social Insurance Fund is forced. Due to the absence of an employer, the documents cannot be sent by a superior or accounting department for the individual entrepreneur. Therefore, the entrepreneur will need to independently contact the Social Insurance Fund, concluding an appropriate agreement. A similar situation arises with persons who are defined as self-employed.

Can an individual entrepreneur go on maternity leave without registration? No, because it is impossible to confirm the fact of transfer of funds to the fund.

Additional Information! There is no need to register with the Social Insurance Fund if the individual entrepreneur has another official place of work. Then, in order to receive payments from the social fund, he can contact the employer with a corresponding request.

What if you don't pay insurance premiums?

Previously, private entrepreneurs were required to make insurance premiums regardless of the income received, but relatively recently there have been significant changes in the legislation.

A woman entrepreneur has the right not to pay insurance payments if she has been on maternity leave for a year and a half and does not receive income.

Thus, she has the right to “freeze” her business for a certain time.

To do this, you must submit a number of documents to the Pension Fund of Russia (PFR) in order to confirm the suspension of activities: an application, the baby’s birth certificate, an extract from the current account, a certificate from the tax service about the lack of income.

Is it possible to go on maternity leave if the employer is an individual entrepreneur?

An employee working for an individual entrepreneur is a full-fledged labor unit. If a citizen is officially employed, then an employment contract was signed with him. This document is a full-fledged basis that can be used to obtain leave during pregnancy. The entrepreneur will not have the right to refuse the request.

But an important condition is to obtain information about income, because it is they that affect the payments that a citizen will receive during maternity leave. For calculations, data for 2 years is taken. If an employee does not work for the company for a full period, then salary certificates from the previous place of work are requested.

Documents required for registration

The payment is assigned upon receipt from the applicant for benefits of a set of documentation, including:

- A certificate issued by the registry office when registering the fact of birth;

- Statement of desire to receive social benefits for the specified child;

- If the child is not the first, then it is required to provide a certificate for previously born ones;

- If you work part-time, you also need a certificate of non-assignment of benefits at the place where you work part-time;

- Certificates of earnings from previous jobs, if in the last 2 years the applicant for benefits performed labor functions in other organizations and received income there. The document is necessary for the correct calculation of the benefit amount;

- A certificate from the company where the other parent works about not assigning him the benefit in question and not providing child leave. If the other parent is not employed, a certificate must be obtained from social security.

The latter document is necessary to eliminate the double purpose of social benefits for one child.

Rules for registration of maternity leave

In order for an individual entrepreneur to be able to go on maternity leave, he must carry out the appropriate procedure correctly. The process is similar to that in other cases of an employment relationship between an employee and an employer.

The responsibility for calculating amounts when going on maternity leave rests with the entrepreneur or accountant himself. The source of funds is the individual entrepreneur’s wallet.

An important rule is the package of required documents. For further release from work, you must submit to the Social Insurance Fund:

- a copy of the two main spreads;

- certificate of registration in connection with pregnancy;

- certificate from the husband’s place of work;

- birth certificate (if available);

- certificate of incapacity for work.

Certificate from place of work

In this case, it is necessary to take into account the nuances that affect how an individual entrepreneur receives maternity leave:

- the contract does not need to be attached, since a second copy is kept in the department;

- the application must contain information about the method and account where funds must be sent (sometimes it is necessary to specifically open a separate account to receive government money);

- You must contact the department to which you submitted your application for participation in the social system;

- confirmation that the spouse does not have the fact of accrual of funds on similar grounds.

How are they paid?

Private entrepreneurs make contributions for insurance payments only to the Russian pension fund.

However, if you self-register with Social Security to receive government benefits, you will pay annual payments .

It can be calculated using the following formula: minimum wage * 2.9% * 12. Naturally, you can pay the entire amount in full or quarterly.

Those persons who have not violated the payment deadlines for the previous year can count on receiving funds.

The amount of funds also depends on the amount of the minimum wage . It is determined by taking into account the insurance period, i.e. the time of making contributions to the Social Insurance Fund.

What is the payment amount?

When determining the amount of payments, the responsible person must analyze the income received by the employee over the last two years. In cases where the period of work is less than two years, the employee must submit income certificates and relevant reports at the request of the entrepreneur.

The individual entrepreneur will receive funds paid to the employee on maternity leave at the expense of the Social Insurance Fund. In 2020, in some regions of the country, another scheme began to operate, when funds are received by a person on maternity leave directly from the Social Insurance Fund.

Additional Information! The legislation does not define restrictions on the amount of accrued payments.

The employer does not have the right to refuse to make payments if a standard employment contract is concluded between the individual entrepreneur and the employee. When requesting maternity leave, the employee must submit a sick leave certificate that confirms the person’s situation.

If an entrepreneur decides to fire such an employee during pregnancy, then the legislation will not allow the procedure to be carried out. Pregnant women are a socially vulnerable segment of the population, therefore the state obliges employers to provide funds and keep the employee on staff throughout the entire maternity leave.

There is only one case when dismissal will become possible - the expiration of the employment contract, if it had a corresponding clause. But this is followed by an obligation imposed on the employer to offer available vacancies to the dismissed employee.

It will be possible to finally dismiss a person only if there are no places or the woman herself refuses the offer.

Step-by-step instruction

To calculate the amount of monthly care allowance for up to 1.5 years, you must follow the following step-by-step instructions:

- Step 1. Determine the billing period.

- Step 2. Identify the presence of days excluded from it.

- Step 3. Calculate total earnings for the period.

- Step 4. Set the average daily earnings for the benefit.

- Step 5. Compare it with the minimum value.

- Step 6 . Compare with the maximum daily earnings.

- Step 7. If the daily income is greater than the minimum and less than the maximum, then the monthly payment is calculated. If it is less than the minimum, then 40% of the minimum wage is paid, if it is more than the maximum, the maximum permissible payment amount is assigned.

Calculation period and excluded days

To calculate average earnings two calendar years preceding the year in which maternity leave began are used.

Articles on the topic (click to view)

- What to do if you haven't paid your salary

- Dismissal due to loss of confidence: judicial practice

- Dismissal for drunkenness: step-by-step procedure

- Dismissal of a pensioner: is it necessary to work for 14 days?

- Limitation period for labor disputes in 2020

- An employee brought an electronic sick leave: what to do?

- Order to reduce staff: sample 2020

If the employee worked in another place during this period, then he must submit a certificate from his previous place of work about the amount of earnings in order to include his income in the calculation base.

The following days are excluded from the billing period :

- temporary disability due to illness;

- temporary disability due to pregnancy and childbirth;

- maternity leave;

- leaves without pay;

- vacations with full or partial preservation of wages, if these amounts were not subject to contributions to the Social Insurance Fund.

If in the previous two calendar years the employee was on maternity leave, then he has the right to choose earlier periods for calculating benefits.

Shifting periods for calculating monthly payments up to 1.5 years occurs at the request of the recipient, subject to the following conditions:

- This calculation will not result in a reduction in benefits.

- The calculation period will only be the years immediately preceding the year in which the employee took up to 3 years of care leave.

What income is taken into account and what is not?

The calculation includes all earnings for which insurance premiums were paid . Such incomes are:

- salary;

- incentive bonuses (monthly, quarterly or annual);

- amounts of vacation pay and compensation for unused vacation.

The calculation of the monthly benefit for up to 1.5 years does not include amounts for which insurance premiums are not paid.

A complete list of amounts that are not subject to taxation as contributions to all funds is listed in Art. 9 of Federal Law No. 212-FZ and Article 20.2 of Federal Law No. 125-FZ.

The most common types of payments not taken into account in average earnings are:

- Carried out at the expense of social insurance (payment of sick leave and temporary disability due to pregnancy and childbirth).

- Payments provided for by a collective agreement or other local regulations of an economic entity, and not of an incentive nature (payment for food, travel, fuel, uniforms, etc.).

Those indicated in the calculation of monthly maternity benefits up to 1.5 years should be excluded.

How to calculate average earnings?

In order to calculate average earnings, you must first find the daily average . To do this, you need to add up the amounts of income for the 2 years that preceded the year the insured event occurred. In this case, the payments specified in the previous paragraph of the article are not included.

You should compare the annual income received with the maximum amount of the base

for insurance premiums for calculation. Every year the base value is indexed.

For comparison, the maximum indicators for those years included in the calculation period are taken.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Annual income exceeding the specified limits for the relevant year in the calculation of total income If in any year more is earned, then the limit value is substituted into the formula.

We divide the result by 730 - the number of calendar days in a year minus the excluded days. The law provides for leap years, so the number of days can be 731.

When calculating the monthly benefit in 2020, you should take the number 731, since 2020 was a leap year.

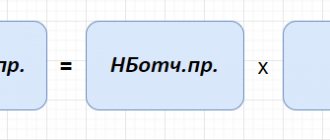

Formula for calculating average daily earnings:

SrDZ = SrZ: (Dk - Di)

- Average daily earnings;

- SRZ – total earnings for the period;

- Dk – calendar days for this period;

- Days that should be excluded from the calculation. These are days of sick leave, labor and child care leave, and days without pay.

This is important to know: Limitation period for labor disputes in 2020

Comparison with minimum and maximum value

The resulting daily income value must be compared with the minimum acceptable and maximum possible .

The minimum daily rate is calculated from the minimum wage: minimum wage * 24 / 730, for 2020 it is 311.97 .

Based on the comparison results, the following conclusions are drawn:

- If the calculated average daily earnings are less than the minimum , then the benefit amount will be 40% of the minimum wage.

- If it turns out to be more than the maximum , then the largest benefit is paid (for 2020, 24,536.57 rubles).

- If it falls between the minimum and maximum , then further calculation of the maternity payment is carried out.

to contents

Formula for determining maternity leave

To calculate the amount of monthly payment for a child until he reaches 1.5 years old, you need to use the following formula:

- Where Rp is the amount of benefit,

- Average daily earnings;

- 30.4 – average number of days in each month;

- 40% is the coefficient.

The result obtained should not be lower than the minimum established by law. In 2020, the minimum amount is set at 3142.33 rubles for the first child and 6284.65 rubles for the second and subsequent ones. The amount of the benefit should not exceed the maximum statutory maximum of 24,536.57 rubles

Example of calculating monthly payment for 2020

Example conditions:

Calculation:

The employee worked for 2 full calendar years, excluding March 2020.

We compare it with the minimum and maximum values, 731.99 is within acceptable limits.

We multiply the average daily earnings by the average number of days in a month and apply the coefficient established for this type of insured event:

731,99 * 30,4 * 40%= 8901, 02.

We compare with the limit values established by law. This amount falls within the standards, so the amount of the benefit will be 8901.02 rubles.

Maternity leave for self-employment

Self-employment and maternity leave can be combined. Self-employed persons have every right to receive payments from the Social Insurance Fund during maternity leave.

But for this there is an important condition established by Federal Law No. 255. Payments are made only to those persons who made transfers in the last reporting year.

Therefore, to receive maternity funds in 2021, you will need to sign an agreement and pay income for 2020.

To register, a self-employed citizen must apply to the Social Insurance Fund with an application containing a request for payment and attached documents. The registration code from the fund will be issued within 7 days. After receiving this code, all that remains is to pay for insurance.

Additional Information! The father can apply for the opportunity to receive government payments. An important condition in this case is the absence of a similar benefit from the mother of the child.

Determining the amount of maternity leave pay depends on the minimum wage and the amount received as benefits at the minimum rate. A decree for individual entrepreneurs is a completely legal right if the person has made transfers to the social fund during the last year.

Also, the entrepreneur himself must make payments to employees who require maternity leave.

*Prices are current as of February 1, 2020

Targeted cash payments provided to new mothers are considered one of the mandatory areas of material support for this category of the population. Moreover, the value of the amounts is subject to periodic change.

In particular, in 2020 the amount of maternity benefits will increase, which is directly related to the increase in the level of the minimum wage (minimum monthly earnings). And since the issue of increasing payments is considered particularly relevant, it is worthwhile to separately understand what amounts you can count on after the introduction of adjustments.

Calculate the new vacation period after maternity leave online

The law allows you to do this. In addition, if an employee worked for several years in a row without rest before the birth of her baby, now she has the right to use all the rest days she is entitled to. If a woman who has given birth to a baby is going to entrust someone else with caring for the child, she has the right to take calendar leave. But they have an equal right to continue working until the very moment of childbirth, and also to begin work before the end of the allotted time to restore health (70 days). In addition, a pregnant woman has the right to receive annual paid leave both before and after maternity leave. Pre-sick leave for pregnancy This opportunity should be provided at any enterprise, both private and public, if the employee has not yet taken advantage of her annual paid leave in the current year. You can get legal 28 days of vacation by contacting your superiors or the accounting department with a corresponding application.

How will the benefit amount change?

It is worth recalling that maternity benefits (Maternity benefits or, as people say, “maternity benefits”) is one of the types of social security insurance provided to women for the entire period of absence from work for appropriate reasons. The payment is made one-time by the policyholder at the place of work.

It is interesting that if a woman is employed in several jobs, then the benefit is assigned according to the location of each of them.

Expert opinion

Zakharov Vasily Vladimirovich

Practicing lawyer with 6 years of experience. Specialization: family law. Legal expert.

But, of course, the most pressing question concerns the size of this type of material support. In this case, the benefit directly depends on the amount of the minimum wage, which is established at the federal level.

At the same time, do not forget that the amount of social benefits also depends on the number of vacation days. An increase in the period of the latter is allowed based on the woman’s individual health indicators and related factors.

Vacation may be:

- 140 days – standard delivery, without any complications;

- 156 days – difficult childbirth;

- 194 days – multiple pregnancy;

- 70 days in case of adoption of a child;

- 110 days for adoption of 2 or more children.

In addition, the amount of financial support is calculated based on the average salary of a woman for the 2 years preceding the date from which the leave was taken. The period from January 1 to December 31 is taken into account.

And here it is important to clarify that the amount of financial assistance has not only minimum, but also maximum limits, limited by the highest average daily earnings. Simply put, even if the payment accrued in the end exceeds the established value, the mother will receive only the maximum amount.

In 2020, the minimum maternity payment amount will be:

- 140 days of vacation – 51 thousand 919 rubles;

- 156 maternity days – 57 thousand 852 rubles;

- 194 days – 71 thousand 944 rubles.

But the largest values will be as follows:

- 140 days of maternity leave – 301 thousand rubles;

- 156 days of vacation according to the BiR - 335 thousand 506 rubles;

- 194 days – 417 thousand 232 rubles.

The amounts presented are not subject to indexation. This means that throughout 2020 the benefits will not change.

How to calculate the days after leaving maternity leave?

According to the standards established by this Legislation of the Russian Federation, after maternity leave, a woman has the right to immediately receive annual leave .

According to Article 260 of the Labor Code of the Russian Federation, this category of employees is entitled to a paid rest period, the duration of which cannot be less than 28 days. In some cases, this period may be increased, but it cannot be reduced under any circumstances.

In addition, when calculating the days of allotted leave, days unused before maternity leave, accrued to her before she went on sick leave for pregnancy and childbirth, can be taken into account.

Also, days off are due for 140 days during which the woman was on maternity leave. The period of child care does not give the right to another vacation, since it is not included in the vacation period.

Calculating the number of days of annual leave required involves several steps:

- Calculation of the number of vacation days unused before maternity leave .

- Determining the number of days allotted for sick leave lasting 140 days - 11.65 days of regular leave are allotted.

- Addition of the above amounts.

The duration of maternity leave is 140 days or 4 months 20 days, which is rounded up to 5 full months.

With an annual duration of 28 days, each month is allocated 2.33 days (28/12), therefore, during maternity leave for pregnancy, a woman is entitled to 2.33 * 5 = 11.65 days .

You can round up to 12 days at the request of the employer.

What billing period should I use?

When calculating the amount of vacation compensation for a woman who returned from maternity leave and immediately took paid leave, special attention is paid to determining the billing period.

According to the rules of the Labor Code of the Russian Federation, the billing period must be taken as 12 months preceding the annual vacation time . An employee who was recently on maternity leave did not work for 140-194 days, provided for maternity leave, and until the child was 3 years old.

The exact duration of maternity leave depends on specific circumstances - the nature of the birth, multiple pregnancies, etc.

It is important to take into account that sick leave for pregnancy is included in the billing period, but child care is not . Therefore, when determining average earnings, payments accrued to the employee’s account during this time should be taken into account.

If a woman immediately went to work after sick leave , then she has no excluded periods, and the billing period will be 12 calendar months before the month of registration of the next vacation.

If a woman went to work after caring for a child , then she had no income in the previous 12 months. In this case, you can replace the period with an earlier one - taken 12 months before the start of the maternity leave. The right of replacement is stated in Decree of the Government of the Russian Federation of December 24, 2007 N 922 (as amended on December 10, 2016).

Calculation of average earnings?

An equally important role when calculating the vacation amount after leaving maternity leave is played by the average daily earnings.

Income for calculating average daily earnings includes:

- the amount of wages received during the pay period;

- various bonuses, allowances and additional payments.

The regional coefficient is taken into account as part of the added income.

If there was an increase in salaries in the billing period, then indexation is carried out.

is not taken into account :

- vacation pay;

- travel allowances;

- one-time bonuses;

- one-time benefits;

- dividends and interest amounts;

- compensation of various types;

- bonus payments received for participation in competitions and contests;

- subsidies of all types;

- sums of money that acted as a holiday present;

- benefits for caring for a child with a disability.

The procedure for calculating vacation payments after maternity leave is carried out in a standard manner. First of all, the amount of income for the billing period is determined. To do this, you need to add up all the accruals that were credited to the employee’s account during this period. The list of payments is provided above.

Next, you need to determine the amount of time actually worked. If a month is fully worked out, then the number of days in it is 29.3 - this is the coefficient of the average monthly number of days. If the month is incomplete, then the number of days in it is determined as calendar days worked, divided by the total number of calendar days and multiplied by 29.3.

Formula for calculation:

Average earnings = (All income / Number of complete months * 29.3 + Number of days in partial months)

Vacation formula for annual holidays

Once the average earnings have been determined, you can calculate vacation pay for annual leave:

Calculation formula:

Vacation pay = Average earnings * Vacation days

Who can claim payment

The status of the woman entitled to benefits does not matter. The exception is, in principle, unemployed women. Mothers in this category do not, by default, have the ability to request this type of support.

If we consider more specifically, the benefit is provided to women belonging to the following groups:

- working women (in this case, the activity must be carried out officially and in the presence of an employment agreement);

- unemployed mothers laid off due to the liquidation of the organization within 1 year before the day they were recognized as such;

- full-time female students;

- women contract employees;

- mothers who have adopted a child and belong to one of the above categories.

The benefit is only provided if the woman uses her leave entitlement. If the young mother continues to work and, accordingly, receive income, she will not be able to apply for maternity leave.

This is due to the fact that the employer does not have the right to provide two types of payments at once - wages and labor and finance. Therefore, only wages are provided for working days.

If a woman decides to exercise her right to leave and stops working, she will immediately be placed on maternity leave, and wages will no longer be accrued. After which the responsible person will calculate the amount of the benefit depending on the size of the average income.

If a woman does not belong to the working part of the population and is included in another category (students, employees, etc.), she is usually assigned a minimum amount of payment. Fixed amounts are indicated above.

Who is entitled to child care payments?

The following persons are entitled to monthly child care benefits:

- mothers, fathers and other relatives working under an employment contract;

- unemployed mothers, fathers and other relatives;

- full-time students;

- dismissed mothers, fathers and other persons during the liquidation of the enterprise;

- mothers and fathers serving under contract;

- mothers who adopted children under 3 months of age.

The amount of payments is established by Article 15 of Law No. 81-FZ of May 19, 1995 “On State Benefits for Citizens with Children” (hereinafter referred to as Law No. 81-FZ) and is:

- 40% of average earnings for working citizens;

- 40% of the minimum wage for working citizens if they have no income for the last 24 months or their average earnings are below the minimum wage;

- scholarship amount for students;

- a minimum fixed by law for the unemployed, dismissed persons and wives of conscripted military personnel.

Working persons apply to the employer for payment, and all others apply to the social security authorities.