Hello! In this article we will talk about trust management of assets.

Today you will learn:

- What does trust management give to the owner of the assets;

- What assets can be entrusted to the management company;

- How does the asset management process work?

- Who can transfer personal assets for management;

- How to choose a management company.

Trust asset management: the essence of the concept

In the modern world, lack of time is solved by finding assistants who do some work for us. For example, if you don’t have time to pick up your child from school, you ask one of your relatives to do it.

And there are problems that you cannot solve due to lack of skills. You want to build a house, but you don’t know how to do it. Professional specialists come to the rescue who will approach the issue responsibly and knowledgeably.

In the examples listed, you entrust your responsibilities to others. This is the essence of trust management. You delegate some matters to market professionals who have experience and knowledge. In return, they receive income from you.

Trust asset management is a set of tasks that the manager sets for himself in order to achieve the goals you have set.

The assets may be your company, which you cannot operate due to a long departure. Or you may have to leave your apartment, which is rented out per day, for the duration of your vacation. An experienced mediator will solve your problems and cope with your responsibilities.

In order for a third party to begin managing your assets, you must enter into a special agreement. It specifies the rights and obligations of the parties, the object of the transaction and its validity period. If for some reason you are not satisfied with the work of the intermediary, you are free to find another one by terminating the contract with the current one.

An entire management company with a staff of specialists most often acts as such an intermediary. You can choose any employee you like based on recommendations, his experience or the profitability of his transactions.

Trust management is a new level of solving your problems. The main thing in this matter is to find a professional manager who can accurately cope with new responsibilities.

It is important to understand that intermediaries rarely guarantee the outcome of the transaction. This is due to the legislative framework, which does not allow specific figures to be presented to the client. This nuance must be written down in the agreement, and it is worth paying special attention to.

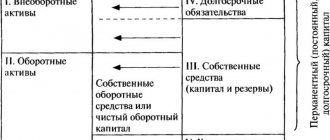

Assets are most often understood as the property of an enterprise that is on its balance sheet. These include current and non-current assets.

Concept and types of assets

Definition 1

Assets are objects owned by an individual or legal entity and having a monetary value.

Assets can be tangible, intangible or financial. Tangible assets have a tangible form. Intangible assets are objects of intellectual property that do not have a tangible form. Financial assets include various financial instruments - cash, securities, financial investments, etc.

More significant from the point of view of organizational management is the classification of assets according to the nature of their participation in the economic process and the speed of circulation. In accordance with this classification, assets are divided into:

- Current (current) assets are assets that an organization consumes or uses during one production cycle. Current assets are intended to service the current operating activities of the company and characterize its property values. Current assets include all types of assets with a useful life of up to 1 year (or until the end of the production cycle) - inventories of materials and finished products, cash, short-term receivables and financial investments;

- Non-current assets are assets that an organization uses repeatedly. These assets underlie the company's business activities over an extended period of time. Non-current assets include all types of assets with a useful life of more than 1 production cycle or 1 year - fixed assets, intangible assets and long-term financial investments.

Finished works on a similar topic

- Course work Management of organizational assets 480 rub.

- Abstract Organizational asset management 270 rub.

- Test work Managing the assets of an organization 230 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Benefits of trust management

The transfer of one's own assets under the control of intermediaries is popular and gaining momentum. More and more people want to earn high incomes, but at the same time not waste personal time on them.

It is worth noting that trust management has a lot of advantages, which attracts new adherents.

The main advantages of this process:

- High profit . Most often, it is higher than what you would get if you managed it yourself. It depends on the professionalism of the mediator and the period for which his powers are delegated. True, you will have to pay for the opportunity to receive increased income. But the total amount you will receive will be rather large. We have already said that management companies will not tell you how much income you can get, but pay attention to the previous experience of the intermediary. Based on it, one can draw a conclusion about the effectiveness of its work;

- Well-functioning control system . The specialist knows how the market behaves and can adapt to the current state. He will sell assets in a timely manner or purchase new ones, depending on the terms of the contract. Any manager has his own tactics and management methods, but different strategies can be used. The owner of the capital does not have deep knowledge, and therefore there is a risk of making an unprofitable deal, which could result in the loss of part of the funds;

- Generating income has a high speed . If you suddenly need the entire invested amount, you can return it. However, it is not recommended to do this, since you will definitely not make a profit. In addition, this will ruin the relationship with the management company, which next time may not meet you halfway on some issues. It is also possible to withdraw part of the capital from circulation. The withdrawal is carried out in a matter of days, which will allow you to quickly resolve possible difficulties;

- Individual attitude towards the owner of capital . If you transfer a large amount of capital or, for example, your business to management, you will deal with a personal manager. He will personally deal with your project, you can always contact him and ask any question. With the help of an individual consultant, it is possible to adjust the terms of the transaction, change the amount of assets or terminate the contract early.

You transfer your assets to a competent specialist who will carry out all operations for you according to the terms of the agreement. His services are paid based on the results of the transaction and amount to several percent of the income received.

In rare cases, the intermediary takes a fixed amount, which is specified in the agreement. The asset manager is aimed at maximum results: the greater the profit, the greater his income. Accordingly, a fixed rate in no way motivates a specialist to achieve high results.

How does asset management work?

Professional asset management came into our lives from the banking sector. In essence, clients deposited funds, the bank disposed of them, and people made a profit. Over time, the number of tools has increased.

According to expert estimates, this financial industry is one of the most popular in the world, the total value of which at the end of the previous year was estimated at more than 100 trillion. dollars.

To begin with, an agreement is drawn up with the client, which specifies what exactly is being transferred to management and what rights the company or financial consultant has. Of course, the validity period is a very important part. If at the end there are no claims from the parties, then, as a rule, the contract is extended and, if necessary, additions are made to it. Methods and tools for investments remain with those to whom the funds are entrusted, but at the same time, the share of financial responsibility is also prescribed.

Trust management tasks

When you enter into an agreement with a management company, you need to discuss a list of goals that you want to achieve through the transfer of assets.

It may not always be getting the highest income. Perhaps you leave your property to look after and pay utility bills during a long vacation.

The agreement specifies the intermediary’s tasks, which are based on your requirements. Often their list for different assets has common principles.

We list the most popular among them:

- Receiving income . The manager tries to earn the maximum possible profit given the current state of the market. This is achieved through the mobile change of management and trading techniques. As we have already said, the intermediary does not guarantee any profit at all, since market fluctuations cannot always be predicted. However, his income from previous clients may significantly lag behind what he will receive when managing your assets under a successful set of circumstances;

- Security of assets . The manager does everything to ensure that your property does not get lost, that it is not stolen or damaged. This clause is stated in the contract and may contain some reservations. For example, the intermediary company is not responsible for the integrity of your assets in the event of natural disasters, military operations or radiation exposure. In addition, you must take care of protecting your property yourself. For example, take out an insurance policy, install surveillance cameras or provide a fire safety system;

- Fulfilling customer requirements . If you have set a goal to earn money in the foreign exchange market, then the intermediary does not have the right to arbitrarily dispose of your money in another direction. For example, he does not have the right to purchase real estate using your funds instead of currency. Otherwise, he will have to answer in court to the fullest extent of the law. If you have indicated payment for all utility bills, receipts for which will be in the mailbox, then the manager is obliged to pay for all of them without exception. Otherwise, he will violate the terms of the contract, as a result of which you may demand compensation;

- Competent management of financial assets depending on the current market situation . The intermediary must know not only the basics of the area in which your assets are traded, but also deep knowledge that will help him achieve maximum success. Experience is an important factor when looking for a professional property manager. Knowledge of theory is not comparable to practice, and therefore you should not trust property to persons without practical experience. Otherwise, you risk being left without money.

Types of Asset Management

There are several types of trust management of property and, to a large extent, they depend on the object of management.

They may be:

- Capital . The most common type of asset management is the transfer of equity capital to an intermediary. The manager can, at his own discretion or at the request of the client, place funds in profitable projects that will generate income. Monetary assets are the most mobile asset that can be placed on the foreign exchange or stock market, invested in real estate, etc.;

- Securities . Typically, the contract is concluded for a period of 6 months to a year. There are three types of stock market trading strategies: conservative, moderate and aggressive. One of them is selected depending on the client’s goals. If you want to get a high income, but at the same time are not afraid of losing your invested funds, then you should choose an aggressive management policy (invest money in shares of new companies). For those who value their own capital, it is better to adhere to a conservative strategy (buy government bonds). The moderate strategy is a middle option between the two listed;

- Currency market . Managing the process of buying and selling currencies on the Forex market is a risky business that can leave you completely without capital in a matter of seconds. It is important to find an experienced specialist who has been involved in the foreign exchange market for several years, knows various trading techniques and knows how to analyze the political and economic situation in the country. The effectiveness of trading depends on his actions;

- Real estate . Surely you have contacted realtors at least once to find a rental property, sell or buy real estate. Agencies or private specialists help to carry out transactions in compliance with the law. You can also leave the apartment under supervision during a long trip;

- Business . Effectively managing an entire company is a complex process that requires a lot of time and large investments. You can entrust this process to professionals who will solve your problems. Most often, a business is transferred to management during the absence of the owner.

There is also such a type of asset management as integrated. It includes several assets at once. For example, you place your accounts on the foreign exchange and stock markets, as well as a certain amount of funds at the disposal of the broker, with placement at the discretion of the manager.

Features of assets

Intangible assets are assets of an enterprise that do not have a tangible form, but participate in economic activity. Consider this type of asset:

- – business reputation (the difference between the market value of an enterprise as a complete property complex and its book value, formed in connection with the possibility of receipt of a higher level of profit (compared to the industry average) due to the use of a more efficient management system, the use of new technologies , etc.) Goodwill is in the broad sense benefits that a company receives for the purchase of an existing enterprise. These advantages may lie in the availability of a fixed clientele, an advantageous geographical location, a competent management team, etc. Goodwill arises at the time of purchase and appears only on the buyer's balance sheet as the difference between the purchase price (the value of the business as a whole) and the sum of its individual assets less its liabilities. Calculating the amount of goodwill often presents a known problem, since the value of the individual value of assets is typically used by their market (but not their balance sheet).

- patents, copyrights and trademarks,

- ownership rights to rental property and its improvements,

- rights to development costs and natural resource development costs,

- formulas, technologies and samples (for example, software),

- know-how – a set of technical, technological, organizational, commercial and other knowledge agreed upon in the form of technical documentation, descriptions. Accumulated know-how, innovations that are subject to, but not patented.

- a trademark is an emblem, design, symbol registered in accordance with the established procedure, which serves to distinguish goods of this production from other similar goods

- licenses,

- other similar types of organizational ownership.

Recently, for an enterprise, more and more value is taking on this form of ownership as intangible assets. This is caused by the furiously developing processes of acquisition of other enterprises, significant changes in the production technology of goods and services, and the increasing role of information technology.

The use of intangible assets in economic circulation gives a modern enterprise a chance to change the structure of production action. Due to the increasing share of intangible assets in the cost of new products and services, their scientific intensity increases, which is very important for increasing the competitive volume of products and services.

As sets of material and tangible assets used as labor tools in the case of production, performing work or providing services or for managing an organization for a period exceeding 12 months or the normal operating cycle, if it exceeds 12 months, belongs to the fixed assets of a building, structure, working and Power machinery and equipment, measurement and regulation of devices and devices, computer facilities, vehicles, tools, production and economic stock and accessories, work and productive cattle, long-term installations, intra-economic roads and other fixed assets. Capital investments in radical land improvement (drying, irrigation and other improvement works) and in leased fixed assets also belong to fixed assets. As part of fixed assets, land plots that are owned by the organization, objects of management of environmental protection measures (water, land, subsoil and other natural resources) are considered. Do not consider fixed assets, and are considered in organizations as part of the funds in trade turnover, and in budgetary organizations - as part of invaluable objects and other valuables: a) objects with a useful life of less than 12 months, regardless of their value; b) objects the value for the date of acquisition greater than 100 times the size (for 50 budget organizations) the minimum wage rate for the unit (the origin of their value provided in the agreement) regardless of their useful life, with the exception of agricultural vehicles and tools, construction has mechanized tools, weapons, and also labor and productive cattle, which belong to fixed assets regardless of their value; c) the following objects, regardless of their cost and useful life: fishing tools (trawls, seines, nets, etc.), special tools and special devices of a special purpose nature, special clothing, special shoes, and also accessories next to leather: branded clothing intended for the problems of employees of the organization; clothing and footwear in healthcare, education and other organizations on a budget; shoddy (not the name) construction, temporary wooden buildings with a useful life of up to two years (portable warming houses, boiler stations, gas stations) and others. In different industries of the economy, the structure of fixed assets may differ significantly, as this reflects the technical equipment, characteristics of technology, specialization and production organization in these industries.

Stages of asset trust management

To transfer your assets to trust management, you must go through several stages.

We suggest the following sequence of actions:

- Search for a manager . It could be an entire company or a private professional. The main thing is that they have a license for their activities. It is important to find an intermediary who has been involved in his activities for a long time and knows many of the nuances. Check the manager's rating, which is compiled on an annual basis by special agencies. If it is high, then there is no doubt about the integrity of the company. However, it would be useful to find reviews from clients of this intermediary and find out from them what impression they had from interacting with him;

- Provision of documents . You will need property documents, as well as details of your company. At this step, a special application or declaration is drawn up, which contains a list of objects to be managed, as well as your goals and objectives;

- Setting goals . At this stage, it is important to formulate your requirements for the management process as clearly as possible. Your relationship with the intermediary will depend on this. All tasks are written down on a piece of paper. In joint negotiations with the manager, you can make adjustments or set other plans;

- Signature of the agreement . It specifies the rights and obligations of the parties to the transaction, the term of the agreement and responsibility. Read all the lines carefully, there should be no double phrases in the document, and also look at what is indicated in small handwriting. Management companies have a whole staff of lawyers who competently draw up contracts. However, they are drawn up in favor of themselves, and not for the client. Therefore, do not sign if you doubt any points: it is better to discuss everything in advance and, before it is too late, find another company;

- Project implementation . You have the right to be interested in the current management process throughout the duration of the contract. You can ask questions to a specialist and even make corrections if you feel the need for them. On some issues, the mediator will inform you and suggest the most beneficial further actions;

- Payment of commission . It is stated in the contract. Sometimes the manager requires payment of part of the amount when concluding an agreement, and receives the rest based on the results of the transaction. Payment is also possible after the end of the agreement.

Upon completion of trust management, you have the right to extend its term for the next period. To do this, a new agreement is concluded and the terms of the transaction are spelled out.

Step-by-step instructions for asset management

The asset management procedure is implemented in the correct sequence of actions.

To use this service, follow these steps:

- Initially, the citizen who is the owner of the assets realizes the need for the help of an experienced manager;

- a search is made for a reliable and trusted manager, represented by a private specialist or an employee of a large company, and it is important that he has a license, as well as good reviews of his work from past clients;

- transfer of all documentation for existing assets to the selected specialist;

- setting numerous tasks that must be solved by the selected manager;

- drawing up and signing an official contract, and the contract must list all the terms of cooperation between the two participants in the process;

- fulfillment of the main tasks by the immediate manager, and he must strive to realize all the client’s ideas, since the amount of his remuneration depends on this;

- if there are no problems or complaints, then the broker receives his share of the profit.

Who are business angels and why are they needed? See here.

For an asset owner, the most significant stage is the search for a manager, since the outcome of this process determines the outcome of cooperation.

Who can become a manager

Only a specialist who meets the following requirements can manage assets:

- availability of a license in the required field of activity;

- the manager must have knowledge and experience in the chosen area of work;

- good reviews from other clients;

- the possibility of drawing up a formal agreement.

Principles of asset management.

Photo ppt4web.ru Most often people turn to large and reliable organizations. Often funds are transferred for management to employees of Sberbank or other banking institutions. A broker can be a large company or an individual specialist. Some organizations offer management of different types of assets.

Wise choice of company

The profit from transferring assets to specialists for management depends on the wise choice of the organization.

Therefore, when choosing, the following recommendations are taken into account:

- the company must have a good rating;

- You should first read reviews about her work, since if they are negative, then it is better to refuse cooperation;

- you should not choose organizations that offer the lowest prices, since there is a high probability of completely losing your assets;

- Work experience is taken into account, since it is advisable to sign a contract with companies that have been operating for more than 10 years.

It is recommended to sign an agreement only with companies that take into account the wishes of their clients during cooperation.

Who can manage assets on a trust basis

Before transferring an asset under professional management, you need to find an intermediary who will suit you in all respects. It is important to understand that most companies on the market have a narrow specialization, and therefore they do not accept all current assets.

If you want to increase capital or simply preserve it, then you should go to banks. Here you can open a deposit at a small percentage for a period from 3 months to 3 years. You sign an agreement that outlines all the nuances.

Sberbank is especially popular among Russian depositors. It represents a wide variety of programs for certain categories of the population.

You can delegate the management of shares or currencies to a professional broker. This organization often has platforms for trading in securities and currencies.

A banking organization that accepts deposits can also act as a broker. Therefore, if you want to transfer several assets for management, you have the opportunity to do this in one place.

For example, VTB Bank can handle three services at the same time. Large banks have well-formed management funds that are maximally tailored to customer requirements.

There are also traders who will manage currency transactions on a professional basis. They have their own platforms on which the whole process takes place. You transfer funds to a special account, and the trader makes purchases and sales.

Real estate is the object of transactions of real estate companies. There are a huge number of them today, and therefore choosing one of them is a difficult task.

There are many agents and scammers, and therefore it is better to entrust property to large companies that have been on the market for more than 10 years. It is also not easy to find an experienced agent, since employees in such companies do not stay long.

There is also such an organization as a mutual fund that organizes investment management. You can buy several shares, which are a share of the total capital of the same investors.

Each fund has a management company. It records transactions on the securities market, real estate, and various startups. By the way, banks also have mutual funds of the same name. For example, Gazprombank offers the opportunity to purchase shares.

It is important to know that you can contact not only a company, but also an independently working specialist. Sometimes working with the latter is more profitable, since you overpay less, and the manager is busy specifically with your project and pays full attention to it.

Choosing a management company: important tips

Finding a management company is not an easy task, especially if you are doing this for the first time. We want to share with you a few tips to help you make your choice.

So, tips for choosing a management company:

- Find out the company's rating . This information is often contained on the intermediary’s website or on the resources of assessment agencies. The lower the indicator, the more likely it is that the management of the enterprise’s assets will be ineffective and will not bring the desired result;

- Check out the reviews . The main thing is not to read those that are on the pages of the company’s website. They may have nothing to do with reality. It is better to visit thematic forums and find out the impressions of real clients of companies;

- Don't save money . If some intermediary offers to provide services at a suspiciously low cost, you should not contact him. Find out the rates from several companies at once and choose the average one. The low price of services is often associated with a lack of quality or the tricks of scammers;

- Pay attention to work experience . If the company was formed this year, then, without hesitation, look for the next one. You need to find a trusted intermediary who has extensive experience. The optimal period of presence on the market is 10 years. Such a company has already formed a staff of permanent and experienced professionals who will definitely help you;

- See if the sample contract with the company contains a clause about taking into account your wishes in the management process . Some companies do not allow the asset owner to dispose of his property. All transactions are carried out only at the discretion of the intermediary. However, if you want to control the process, you will have to look for another management company.

By following these tips, you will be able to choose an acceptable management company, and your property will not fall into the hands of scammers. Finding an intermediary may take a lot of time, however, it will pay off handsomely in the form of income and other benefits.

Unfinished production

This is the cost of raw materials, main and auxiliary materials, fuel transferred from the warehouse to the store and which introduced the technological process, labor costs, costs of electricity, water, steam, etc. As a result, work-in-process costs consist of the cost of incomplete products, self-produced semi-finished products, and also finished products that are not accepted by the technical control service. The size of work in progress depends on four factors: the amount and composition of products made, the length of the production cycle, the cost of the product, and the nature of the accrual of costs during the production process. The first three factors directly affect the amount of work in progress. At the same time, the duration of the production cycle, in turn, is determined by time: the production process; the impact on semi-finished products of physical and chemical, thermal and electrochemical processes (technological equipment in production); vehicles of semi-finished products in the store, and also finished products in the warehouse (transport stock in production); accumulation of semi-finished products before the next transaction (inventory of goods turnover in production); analysis of semi-finished products and finished products, opening of semi-finished products in inventory to guarantee the continuity of the production process (safety stock in production). The most excellent reduction of these types of inventories in work in progress helps to improve the turnover of goods due to the reduction in production cycle times. In the case of a continuous production process, the duration of the production cycle is estimated from the start of raw materials in production to the output of the finished product. In general, the average production cycle time using the weighted average indicator method i.e. by multiplying the duration of production cycles on individual products or most of them, their cost is determined by the enterprise. In the case of determining input costs at the beginning of the production cycle (raw materials, main materials, etc.), and accumulation is divided by the amount of work in the progress of the fourth factor, i.e. the nature of the increase in costs, all costs in the production process on a one-time basis, i.e. (fuel, steam, water, energy, operating costs, depreciation, etc.). Increases in costs during the production process can occur regularly and unevenly.