An explanatory note to the balance sheet is a document that was previously part of the annual financial statements of organizations. Now “Explanations” are mandatory: let’s figure out what the difference is and how to fill out the required document.

Currently, current legislation does not provide for the mandatory provision of such a form as an explanatory note to the balance sheet for 2020 as part of the annual reporting. However, in most cases you cannot do without it. There are no special requirements for this document, but it is advisable to compile it without errors. Indeed, if the data does not correspond with those indicated in the report itself, the tax service may have questions. Let's see who, when, why and in what form should draw up notes to the balance sheet?

Explanations to the balance sheet and a note are not the same thing

The explanatory note to the 2020 balance sheet, a sample of which can be seen in this article, does not replace the explanation to the balance sheet. By virtue of PBU 4/99 “Accounting statements of an organization”, “Explanations” are a breakdown of the balance sheet items, as well as clarification of individual reporting forms:

- statement of changes in equity;

- cash flow statement;

- other reporting forms and applications as part of the financial statements.

Whereas the note is an arbitrary transcript of the entire financial situation in the organization. It can contain both general information and detailed explanations of the lines of the balance sheet and income statement. According to Article 14 of Federal Law No. 402 dated December 6, 2011 and paragraph 4 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010, this document is included in the annual financial statements. In particular, paragraph 28 of PBU 4/99 stipulates that business entities are required to draw up explanations for the balance sheet and Form No. 2 in the form of separate reporting forms and a general explanatory note. Although officials do not put forward any specific requirements for the form and content of this document, all organizations must submit an explanatory note with a balance.

An exception to the general rule are representatives of small businesses, who have the right to prepare and submit accounting reports in a simplified form. They must provide only two mandatory forms: a balance sheet and an income statement. They do not have to decipher the meanings and describe their financial situation. However, if such a desire arises, it is not forbidden to draw up this document.

Results

Explanations for the balance sheet are allowed to be drawn up in any form. They may contain tables, graphs and charts. The detail of information in them can be very varied - it all depends on the company’s intention to disclose any important indicators in a certain way. The main thing is that the information contained in the explanations is reliable and useful for users.

Sources:

- Order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n

- Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Who needs an explanatory note to the annual report for 2020 and why?

A sample explanatory note to the balance sheet is necessary for all users of financial statements to obtain more complete additional information about the financial and economic activities of a legal entity. Such information, as a rule, cannot be provided in other reporting forms, but it is important and is of interest both to the founders or creditors of the company, and to regulatory authorities. Data in this document can be included based on specific wishes, for example, the board of directors, as well as based on the characteristics of the current economic situation at the enterprise by the end of the year. For example, if the income tax for the reporting period turned out to be significantly lower than the previous one, it makes sense to describe the reasons for this in an explanatory note, since the tax authority, having received such data, will still ask for an explanation. By anticipating this desire, you can avoid not only unnecessary questions from tax authorities and calls to the “carpet” of the inspectorate, but also an on-site inspection, which can be scheduled as part of a desk audit.

***

All large and medium-sized businesses are required to provide an explanatory note as part of their annual financial statements; representatives of small businesses submit such a note if they wish. Explanations to the balance sheet allow you to transform dry figures from the balance sheet and other reports into reasoned text about the financial position of the entity. A competent justification for a decrease in the economic indicators of the payer will help to avoid suspicions of understating profits and the use of schemes to evade taxes and other mandatory payments. In addition to regulatory authorities, interested parties in receiving an explanatory note are investors, creditors, and shareholders of the enterprise.

Explanatory note to the financial statements

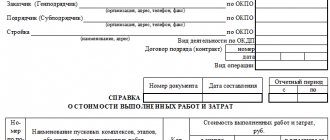

The sample shows what a document might look like, the more precise name of which is “Explanations for the Balance Sheet.” We took the notional organization LLC “Horns and Hooves,” which has been operating since 2005 and is engaged in the production and sale of dairy products. Its chief accountant compiled this document as follows:

Explanations to the balance sheet of Horns and Hooves LLC for 2019

1. General information

Limited Liability Company (LLC) “Horns and Hooves” was registered by the Federal Tax Service No. 1 for St. Petersburg on March 29, 2005. State registration certificate No. 000000000, INN 1111111111111111, KPP 22222222222, legal address: St. Petersburg, Nevsky Prospekt, 1.

The organization's balance sheet was formed in accordance with the rules and requirements of accounting and reporting in force in the Russian Federation.

- Authorized capital of the organization: 5,000,000 (five million) rubles, fully paid.

- Number of founders: two individuals O.M. Kurochkin and I.I. Ivanov and one legal entity "Moloko" LLC.

- Main activity: milk processing OKVED 15.51.

- The number of employees as of December 31, 2020 was 165 people.

- There are no branches, representative offices or separate divisions.

2. Basic accounting policies

The accounting policy of LLC "Horns and Hooves" was approved by order of director Ivanov I.I. dated December 25, 2013 No. 289. The straight-line depreciation method is used. Valuation of inventories and finished products is carried out at actual cost. The financial result from the sale of products, works, services, goods is determined by shipment.

3. Information about affiliates

Ivanov Ivan Ivanovich is the founder, 50% of the ownership share in the management company, holds the position of general director.

Kurochkin Oleg Mikhailovich - founder, 30% share of ownership in the management company.

LLC "Moloko" - founder, 20% ownership share in the management company, Russian organization (founders V.P. Petrov and Yu.K. Sidorov).

During the reporting period, the following financial transactions were carried out with related parties:

- On March 12, 2020, the general meeting of the founders of Horns and Hooves LLC reviewed and approved the financial statements of the organization for 2020. The meeting decided to pay a profit in the amount of 3,252,000 rubles to the founders based on their share in the authorized capital based on the results of 2019. The payment (including personal income tax withholding for two individuals) was made on 04/01/2020;

- On May 25, 2020, Horns and Hooves LLC entered into a contract with the founder of Moloko LLC, Yu.K. Sidorov, an agreement for the purchase of non-residential premises worth 5,102,000 rubles. The cost of the transaction is determined by an independent assessment of the value of the property. Payments under the agreement were made in full on June 6, 2018, and the transfer and acceptance certificate of the real estate was signed.

4. Key performance indicators of the organization for 2020

In the reporting year, the revenue of Horns and Hooves LLC amounted to:

- for the main type of activity “production and sale of dairy products” - 385,420,020 rubles;

- for other types of activities - 650,580 rubles;

- other income: 170,800 rubles (sale of fixed assets).

Costs of production and sales of products:

- acquisition of fixed assets: 1,410,500 rubles;

- depreciation of fixed assets: 45,230 rubles;

- purchase of raw materials: 110,452,880 rubles;

- wage fund: 137,580,040 rubles;

- travel expenses: 238,300 rubles;

- rental of premises: 8,478,190 rubles;

- other expenses: 532,458 rubles.

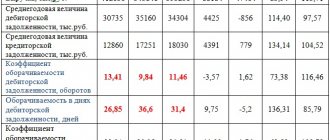

5. Explanation of balance sheet items as of December 31, 2019 (using the example of accounts payable)

Availability and movement of accounts receivable

Index Period For the beginning of the year Changes over the period At the end of the year Accounted for under contracts Provision for doubtful debts Received Dropped out Remainder In thousands of rubles with decimal places Under contracts (transactions) Fines, penalties, penalties Redeemed Written off in Finnish result Written off to reserve for doubtful debts Current Overdue Total short-term accounts receivable, including: 2019 25 489,3 (200,0) 15 632,7 300,4 (25 023,2) (102,1) (48,9) 15 726,1 522,1 buyers 20 409,0 (200,0) 10 015,5 300,4 (17 315,3) (87,7) (48,9) 12 750,9 522,1 suppliers 5080,3 — 5617,1 — (7707,9) (14,4) — 2975,2 — Total long-term accounts receivable, including: 2019 50 000,0 — — — — — — 50 000,0 — for interest-free loans 40 000,0 — — — — — — 40 000,0 — TOTAL accounts receivable 30 489,3 (200,0) 15 632,7 300,4 (25 023,2) (102,1) (48,9) 65 726,1 522,1 6. Estimated liabilities and provisions

As of December 31, 2020, the organization formed an estimated liability for payment of regular vacations of employees in the amount of 7,458,000 rubles, the number of unpaid vacation days is 67, the deadline is 2020.

The reserve for doubtful debts was formed in the amount of RUB 600,000. due to the presence of overdue and unsecured debt of Girya LLC in the amount of 522,000 rubles.

The organization did not create a reserve for reducing the value of inventories in 2020, since inventories do not show signs of depreciation.

7. Salary

Payables for wages as of December 31, 2018 for the organization as a whole amounted to RUB 3,876,400. (payment for December 2020, due date: 01/12/2020). Staff turnover in the reporting period was 14.88%. The number of employees as of December 31, 2019 is 165 people. The average monthly salary is 25,675 rubles.

8. Other information

(In this section you need to describe all extraordinary facts in the business and economic activities of the organization for the reporting period, describe their consequences. You can also describe all other significant facts that affected the balance sheet in general and, in particular, you can list major transactions and counterparties for them for the reporting period, as well as write a forecast or events that have already occurred after the reporting date and are of significant importance.)

Director of LLC "Horns and Hooves" /signature/ Ivanov I.I. 03/19/2020.

When drawing up an explanatory note, special attention must be paid to information about affiliated persons. It is advisable to document this data in a separate section, as required by paragraph 14 of PBU 11/2008. By law, it is necessary to disclose information not only about the founders of the organization itself, but also about persons associated with them, therefore, if the founders (as our example of an explanatory note to the balance sheet shows) includes a legal entity, its participants or shareholders must be indicated. In addition, information on transactions carried out with related parties during the reporting period must be indicated, as well as, regardless of the transactions, on those legal entities and citizens that are recognized as affiliated.

Obviously, competent preparation of an explanatory note to the financial statements can save the manager and accountant from additional communication with regulatory authorities. It is important to remember that the detail of the information in this document depends only on its compiler - on the intention of the organization itself to disclose or not certain indicators for the year. The main and only requirement that the legislator makes for this document is that the information contained in the explanations must be reliable. The person who signed the document is responsible for its correctness.

Sample of a universal explanatory note form

How to compose - sample

Such an explanation is drawn up addressed to the head of the tax office located at the place of registration of the taxpayer on the official letterhead of the institution.

Tax legislation does not regulate special forms of explanations (except for VAT); they are only advisory in nature.

In order to avoid disagreements with the tax service and ease of filling out (registration), it is better to use the form recommended by the tax authorities.

When responding to a request, it is necessary to pay attention not only to the topic (for example, justify losses, explain increases and decreases in salaries, etc.), but also take into account the specific content of the request, since it may require data not only on the specified topic, but also the narrow focus of certain documents.

SAMPLE

To the head of the Federal Tax Service No. 12 for Kaluga

INN 0326465613 KPP 051615456

Address: 215478, Kaluga, st. Geina, 3

Ref. No. 254 dated April 23, 2017

In response to your request from __________ No._______ we provide the following information:

The main activity of the institution is ..... (code ____).

For the fourth quarter of 2020, the institution’s income/expenses from (what type of activity is unprofitable) amounted to _________ rubles:

- incl. sales revenue ___________ rub.;

- expenses - _________rub.;

- incl. straight - __________ rub.;

- indirect - _____________ rub.;

- non-operating expenses - _____ rub.

You can also give a more detailed breakdown of expenses. The more information you provide, the better.

Based on the results of the reporting period, the damage amounts to ______ rubles.

The main reason for this is:

- _______ 1 copy. on 3 sheets;

- etc.

We write an explanatory letter to the tax office

Tax officials periodically request the reasons for identified inconsistencies or inconsistencies in reporting submitted by taxpayers. We will find out how to correctly draw up an explanation to the tax office; we will provide a sample document in the article below.

Reasons for requesting clarification from the tax office

When conducting a desk inspection, the inspector has the right to request written explanations from the organization about the identified discrepancies. Clause 3 of Article 88 of the Tax Code of the Russian Federation indicates the main reasons when it is necessary to give an explanation of what happened:

The company's management must send a reasoned response to the request within 5 days from receipt of the notification.

Responsibility

No matter how much tax officials intimidate with financial sanctions, it will not be possible to hold people accountable for failure to provide explanations.

Let's find out why:

But, in any case, it is better to check and find out why the discrepancies appeared. Perhaps this will help to detect an accountant's mistake when drawing up the report.

Explanation of discrepancies regarding 6-NDFL

Quarterly, the accounting department submits Form 6-NDFL to the Federal Tax Service, which indicates information about income and withheld tax amounts for each employee.

What to do if tax authorities ask for clarification on inaccuracies in the report? To get started you need:

- check all indicators reflected in the form;

- check the indicated figures with other reports with which the tax office is reconciling;

- specify the amount of the transferred tax;

- if it turns out that there is no error, then you need to send a logical explanation; if an error is discovered, send a clarifying report.

If it turns out that there is an error in the personal income tax information, the company may be fined for inaccurate provision of information in the amount of 500 rubles. for each document (clause 1 of Article 126.1 of the Tax Code of the Russian Federation). The company is released from liability if the error was identified independently and corrected. Therefore, every accountant should know the rules for preparing all types of reporting in order to avoid mistakes.

Explanation of low wages

In Russia, the process of legalizing wages is underway. The rule has been established that workers for their work must receive no less than the minimum wage approved at the state level. At the same time, in the regions of the Far North or equivalent areas, wages should be calculated taking into account increasing factors.

If the inspector discovers that in the submitted calculation the workers’ wages are below the maximum value, then he has the right to demand an explanation of the discrepancies.

Reasonable reasons for this situation may be:

- due to the difficult situation of the organization, employees were transferred to part-time work, the salary was calculated based on the time actually worked;

- if the employee went on vacation, then this circumstance can be pointed out. Often employees go on vacation for a long period of time, receive vacation pay in one month, and the subsequent period remains without accruals or they are insignificant;

- There may be another situation, for example, a person got sick, issued a sick leave, and handed it over to the accounting department for payment later;

- If tax officials ask to explain the reasons for the discrepancy in wages from industry indicators, then they can write that workers receive according to the minimum wage level. But it is not possible to increase the amount, since the company is still young and production volumes are insignificant.

Any explanations must be supported by documents. In this case, you can attach orders about vacation, about switching to a shortened working day, payslips about accruals, sick leave, etc.

Late payment of tax, explanation from the Federal Tax Service

For such reasons, inspectors rarely request clarification; they have the right to send a demand for payment of the relevant tax after the expiration of the regulated period for payment.

What to do if the tax authorities asked to indicate the reasons for the delay in paying taxes?

In these cases, financial sanctions can be avoided; the main thing is to respond to the notification in a timely manner and take measures to provide explanations.

Explanation of lack of activity

When conducting business activities, the company's management often encounters financial difficulties, which serves as a reason for suspending activities.

To avoid misunderstandings, it is recommended to immediately inform the tax authority, the Pension Fund of the Russian Federation, and social security services that for specific reasons the organization’s activities have been suspended, employees have been fired, and wages have not been accrued.

Let's find out what arguments can be written in a letter. Most often these are the following reasons:

- due to the economic crisis in the country;

- production volumes have decreased, activities have been temporarily suspended, if work is resumed, the organization undertakes to notify government authorities about this;

- The company decided to liquidate.

Suspension of a company's business activities does not relieve the taxpayer from submitting reports. Penalties are provided for late submission of even zero declaration forms.

How to fill out an explanatory form correctly

The document is drawn up in any form, since there is no approved standard form. The explanation can be drawn up by hand or using computer technology.

When drawing up a document, you should follow the general rules:

- the name of the inspection that requested the explanation is written in the header;

- The answer can be issued on the company’s letterhead. If there is no such form, then you must indicate the full name of the company, OGRN, INN, KPP and legal address;

- the date and number of the inspection requirement for which an explanation is provided should be indicated;

- further details of the situation that require clarification are described in detail;

- It is best to document the facts that caused the discrepancies identified. For example, if an employee’s salary is less than the subsistence minimum, then a vacation order can serve as a supporting document. This will be understandable if vacation pay was accrued in one month, and the rest days were in the next period.

If, after receiving a request from the Federal Tax Service, the organization’s accountant discovers errors in the submitted reports, you must immediately submit corrective declarations.

For the convenience of our readers, we will provide a unified example that is suitable for almost any situation for sending reasonable explanations to tax authorities about identified discrepancies.